Spend-IT: Brokerage firm Angel One maintains high-tech outlay growth to compete with new-age rivals

Mumbai-based stockbroking firm Angel One Limited (previously Angel Broking Limited), is heavily investing in the latest technologies to enhance user experience and streamline operations. According to the company’s Annual reports and TechCircle’s analysis, the firm invests about 4% of its revenue in technology, allocating around 5% in FY24.

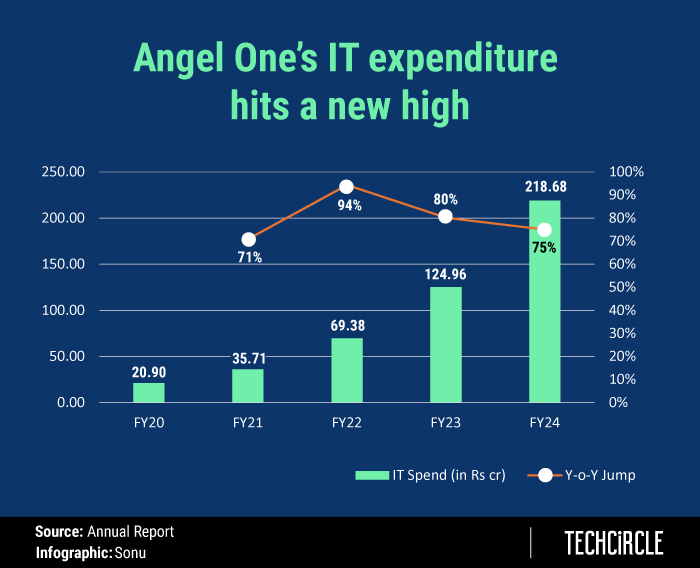

While its technology spending historically increased by an average of 80% year-on-year, it saw a decline to 75% in the last fiscal year. Tech investments have exceeded ₹200 crore-mark for the first time, although this is below the historical growth trend.

Founded by Dinesh Thakkar in 1996, the company has embraced various automation technologies since its early days, attracting a significant number of retail investors even before the internet transformed stock market trading. Currently, Angel One ranks third in active clients on the National Stock Exchange (NSE), following Groww and Zerodha, with over 5 million active clients.

In recent years, the company has actively adopted artificial intelligence (AI), big data analytics, and machine learning, with a strong focus on cybersecurity, including innovations like Zero Trust Authentication to safeguard user data. Its services are accessible through iOS, web, tablet, and Android-powered SuperApp platforms.

This SuperApp, launched in 2022, provides real-time portfolio insights and personalised investment journeys, optimising customer experience and reducing costs by 18%.

Angel One has integrated various technologies, including TradingView for advanced charting and market analysis, boosting engagement and satisfaction. Through cloud computing, it has enhanced scalability and ensured business continuity and Disaster Recovery Plans. These plans include real-time data replication, regular backups, and annual compliance reviews.

The firm uses accounting software such as Oracle, Class, and its in-house systems, relying on its Software-as-a-Service (SaaS) platform Oracle Fusion for financial records management. It has strengthened information security and risk management, employing measures like encrypted data transmission and extensive firewalls, along with real-time monitoring via Security information and event management (SIEM) systems.

With an open architecture and open application programming interfaces (APIs), Angel One enhances client experiences and generates new revenue streams through partnerships with applications like Smallcase, Sensibull, and Streak, as well as those from Vested, Quicko, and MarketsMojo.

In November 2023, Angel One acquired Bengaluru-based fintech startup DStreet Finance to connect more deeply with Gen Z through targeted content and education. The company charges customers across various slabs, remaining competitive with other discount brokers.

As of January 2024, Angel One's customer base reached 20.43 million, marking a 58.5% year-on-year increase, with 1.03 million new clients added that month — a 162.7% rise from 0.39 million the previous year. The firm has a 600-member technology team distributed across Mumbai, Bengaluru, and New Delhi.