Spend-IT: Zomato’s IT expenses shoot past $50mn mark

Food delivery and quick commerce venture Zomato that has emerged as the most valued startup in the country with its share price zooming over the last two years and is currently valued at over $30 billion, has been adding more verticals to its business. It recently inked a deal to acquire the movie ticketing business of Paytm, a move that will increase its computing power needs.

The company went public in 2021 and reported its first full-year profit in FY24. For the full financial year, Zomato posted a profit of ₹351 crore; the previous year it suffered a loss of ₹971 crore.

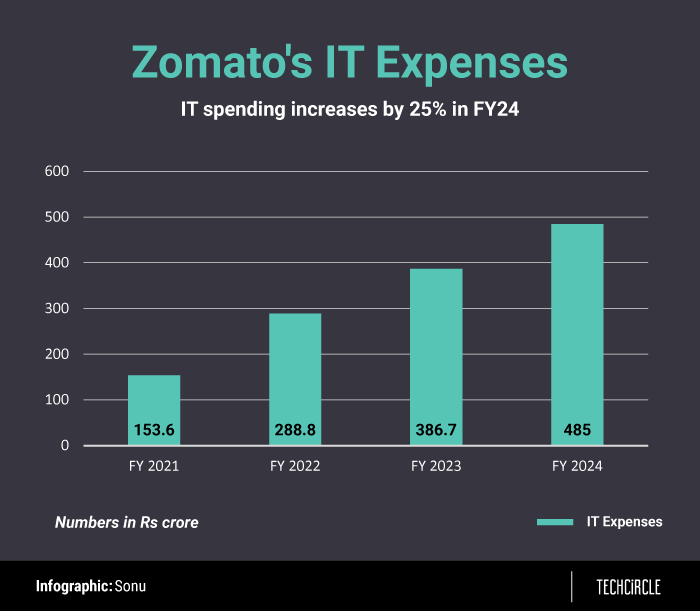

The IT expenditure for the fiscal year increased by 25% year-on-year (YoY) to ₹485 crore from the previous year’s ₹387 crore. That said, the growth has decelerated slightly from the 34% growth between FY23 and FY22.

Zomato, however, did not respond to TechCircle’s queries.

The company handled 753 million orders this financial year (up from last year’s 640 million), and was instrumental in the growth of IT expenditure, along with other costs including software subscription and communications-related expenses. Additionally, it attributes part of this increase to the consolidation of Blinkit financials from August 2022.

The technology firm first leverages artificial intelligence (AI) in multiple spheres of its operations and functionality. In September last year, Zomato launched an AI chatbot called Zomato AI. It is built on multi-agent framework, allowing users to seek recommendations, responses to relevant queries, and food ordering. It is available to paying members. As per Zomato, this feature has enabled faster discovery of options and scaled up the systems to handle high demand. To enhance customer experience, it also introduced a ChatGPT and Midjourney-based Recipe Rover to suggest food recipes.

Further, the company has launched an Augmented Reality (AR) menu feature on its food delivery platform, allowing customers to preview their meals on their tables through their smartphones before placing an order. This innovation offers an immersive and enhanced ordering experience, turning each meal into an exciting opportunity for discovery and engagement.

Zomato’s proprietary geo-location technology led to a reduction in drop location errors. Automation of customer service has also greatly reduced in-app query resolution times, the company said in its annual report.

In March, Zomato expanded its partnership with checkout network provider Simpl. Zomato has integrated Simpl’s 1-Tap Checkout with Zomato Gold, Intercity Legends, and Zomato Everyday to enhance convenience and boost conversions. This move is expected to increase average order value and improve user retention.

Moving forward, Zomato could face strong competition from the government-backed Open Network for Digital Commerce (ONDC), an open protocol developed by the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce. As per an ET report in July, ONDC’s internal analysis showed at the e-commerce initiative has cornered about 3% of Zomato and Swiggy’s food-order volumes. Softbank-backed Swiggy, counted among Zomato’s biggest rivals, is eyeing an IPO filing, seeking to raise more than $1 billion.