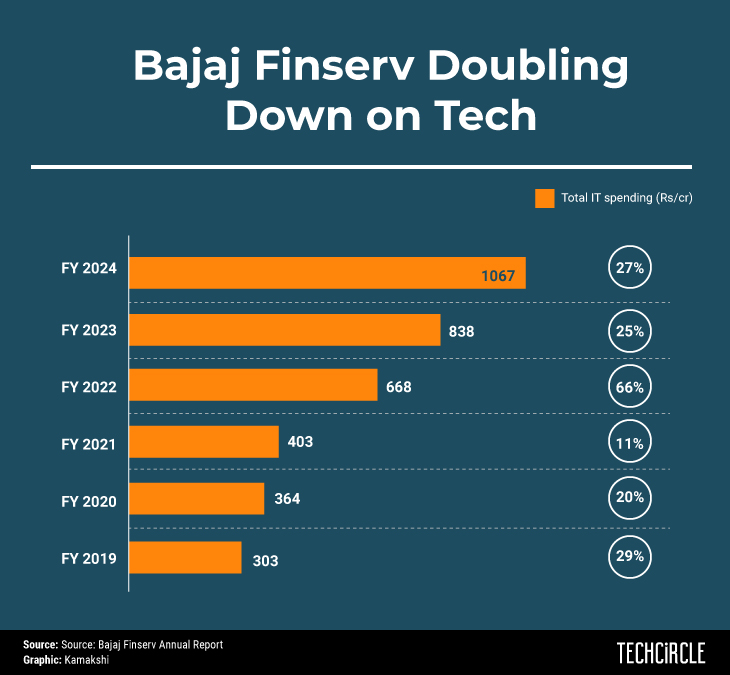

Spend-IT: Bajaj Finserv's tech spends crosses a milestone with 27% jump

Headquartered in Pune, Bajaj Finserv, a non-banking financial company (NBFC), has significantly increased its information technology (IT) spending over the past five years. In the financial year 2024 (FY24), which ended on 31 March, the company allocated ₹1,067 crore to IT—surpassing the ₹1,000 crore mark for the first time. Its tech spending has been on an uptick year-on-year.

The company’s capital expenditure involves adopting IT systems and digitalisation processes. By streamlining multiple operations, Bajaj Finserv has improved customer service by transitioning from traditional offline setups to efficient online modes. Automation and digitalisation have reduced paperwork and operational costs.

The group is adopting emerging technologies by leveraging generative artificial intelligence (Gen AI), optimising cloud technology, deploying next-generation cybersecurity, payment technologies, and augmented reality. This helps the company level up its consumer interface and processes for flagship offerings such as loans, deposits, claims, and investments. These new-age technologies also help it reach areas with no access to financial services.

For instance, Gen AI initiatives are deployed by Bajaj Finance across operations, service, and contact centers to enhance efficiency and create personalised and better user experiences. The company is also leveraging the India Digital Stack extensively, including Account Aggregator and ONDC. Bajaj Allianz General Insurance incorporated advanced technologies to simplify insurance complexities with the launch of its innovative ‘Insurance Samjho’ Gen AI-powered bot.

Incorporating digital solutions helped the company reach far-flung rural locations. Bajaj Finserv is present in 4,145 locations across the country, including 2,576 in rural/smaller towns and villages, which accounts for over 60% of its footprint in rural India. Omnichannel expansion with the backdrop of smart digital solutions has been the focus of the company.

Given its high daily transaction volume, the company heavily relies on IT and digitised solutions. Ensuring appropriate IT application controls is critical to Bajaj Finserv’s operations.

Regarding cybersecurity, each subsidiary within the group adheres to an information security framework, constantly enhancing its security posture. These measures mitigate the risk of fraud or errors.

Bajaj Finserv operates across financial sectors, including lending, insurance, and wealth management. Its market capitalisation exceeds ₹2.52 trillion, and major subsidiaries include Bajaj Allianz General Insurance, Bajaj Allianz Life Insurance, Bajaj Housing Finance, and Bajaj Finance. Bajaj Finserv Direct, an unlisted subsidiary in which Bajaj Finserv holds an 80.13% stake, operates as a financial products marketplace that offers technology services.