HDFC Life tech spending growth decelerates but remains strong

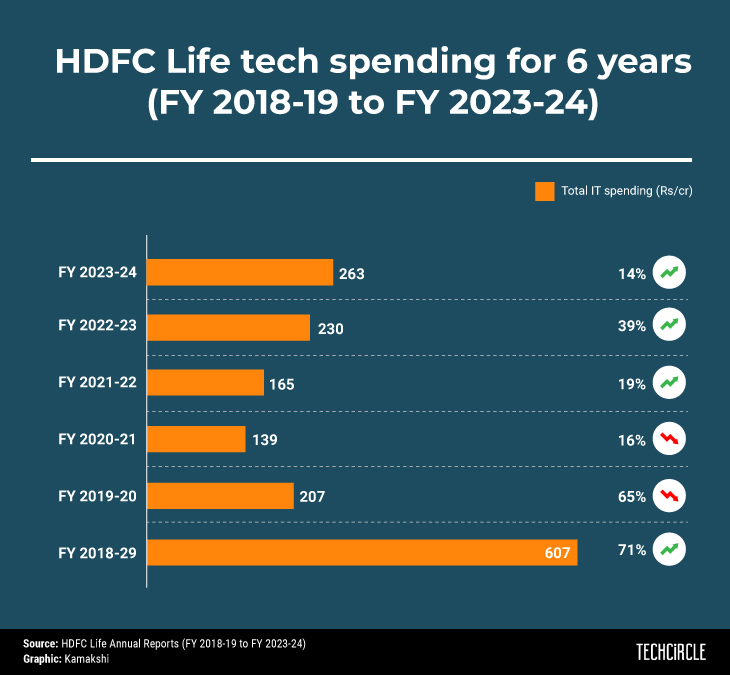

HDFC Life Insurance Company, one of India's largest private life insurers, that has been pushing up its technology expenditure as part of its digital transformation strategy continued the momentum for the third successive year for the twelve months ended March 31, 2024, albeit at a slower pace.

The company that has focused on integrating advanced technologies to enhance its operations and customer experience, upped its IT spending by nearly 14%. This marks a deceleration from the previous year but comes after a higher base due to a big jump in tech spends the previous fiscal, as per a disclosure in its annual report.

This included higher spending on product system testing, development of various business applications, cloud projects etc.

HDFC Life said it is continually upgrading its technology to be ahead of the curve. As part of Project Inspire, it will have a multi-cloud infrastructure supported by newly proposed data platforms and a next-generation technology stack.

It launched multiple AI applications across different customer and partner-focussed assets. These include an NLP-based platform to assist front-line sales teams in answering customer queries, understanding products, and tracking their incentives; a deep learning-based automated underwriting model with higher straight-through processing (STP) rates across savings products; and a GenAI-based galaxy platform for all current and future applications.

“We are also working towards harnessing Gen AI capabilities across business processes, which is intended to help ingest multiple documents and generate insights, provide secure and authenticated APIs to enable seamless integration with other applications, have a built-in library of prompts to assist users and have strict data security protocols,” it said in its annual report.

HDFC Life has also restructured its technology team, creating separate Business Core and Enterprise Technology groups to optimise commercial benefits and core technology developments.

The company had also set up a steering committee comprising members from finance, actuarial and technology to initiate the implementation of IND AS standards. It is in the process of evaluating a technology partner for the implementation.

Major upgrades to enterprise technology stacks have also been carried out, achieving near-zero downtime during peak periods, as per the company.

HDFC Life has also embarked on a large-scale technology transformation for its project called INSPIRE (Intelligent Systems and Platforms for Insurance Reimagination). Originally introduced in 2010, INSPIRE aims to build intelligent systems and platforms for insurance, focusing on IT governance, data architecture, cloud strategy, and cybersecurity.

Additionally, HDFC Life's cloud infrastructure has significantly scaled the company's capabilities, facilitating a transition to a hybrid and multi-cloud model for enhanced operational agility.