The Rise of Crypto F&O in India with FIU-registered Delta Exchange

Ever thought about trading cryptocurrencies without actually owning them? With crypto options and futures, you can!

Finding a reliable platform for trading derivatives in India can be tricky though, especially with the growing popularity of crypto F&O trading, and so many platforms to choose from. Let’s introduce you to Delta Exchange India and explore whether it is a compelling option.

Delta Exchange India allows Indian traders to trade futures and options for Bitcoin and Ethereum. The platform has seen significant trading volumes, with recent figures reaching over $325 million in May 2024. They seem to have gone the extra mile by registering with India’s FIU (Financial Intelligence Unit) - complying with regulations and prioritizing the safety of their users.

Our bottomline is that Delta Exchange India offers several unique benefits that other platforms have yet to provide. We will discuss these benefits shortly, but first, let's understand the basics.

What are crypto options and futures trading?

For instance, if you strongly believe that a cryptocurrency's price will significantly increase in the next month, you may want to consider using crypto options or futures contracts to speculate on your prediction. Here’s a brief overview of these derivatives:

Crypto Futures

A crypto futures contract allows you to buy or sell a certain amount of cryptocurrency at a specific point in the future. There are also crypto perpetual futures, which do not have an expiry date but instead use an auto-roll feature, exchanging funding every 8 hours.

Crypto Options

Crypto options are similar to futures in that you agree to buy or sell at a specific price by a certain date. However, with options, you are not obligated to complete the trade if it is not advantageous, allowing you to let the contract expire without any action. This feature makes options a lower-risk alternative to futures with potentially lower gains.

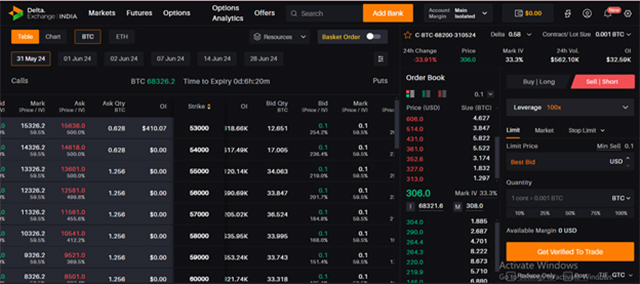

Crypto options market on Delta Exchange India

The rise of Crypto F&O in India with Delta Exchange

The rise of crypto F&O in India is driven by the demand for exposure to cryptocurrencies without owning the assets. Delta Exchange is well-positioned to meet this need. Its user-friendly platform, diverse expiry options, and advanced risk management tools appeal to both new and experienced traders.

Transacting in INR and avoiding direct crypto ownership simplifies trading and reduces tax complications. Delta Exchange's first-mover advantage and local market focus, combined with impressive aforementioned trading volumes, highlight its potential for success in India's growing crypto derivatives market. The platform provides a sleek interface and numerous advantages. Let's take a deeper look at them.

One-of-a-kind benefits offered by Delta Exchange India

Diverse expiry options

Delta Exchange India offers daily, weekly, and monthly expiries in crypto options, catering to the diverse needs of traders and investors.

Accessible lot sizes)

With small lot sizes starting at INR 5,000 for Bitcoin contracts and INR 2,500 for Ethereum contracts, Delta Exchange India makes it easy for traders to get started.

Round-the-clock support

Benefit from 24/7 customer support. It is ideal for beginners and is available to assist with any queries or issues at any time of the day.

Advanced risk management

Delta Exchange India employs advanced risk management techniques, enabling traders to engage in larger trades with less capital and reduced risks.

Fiat-only transactions)

Trade on Delta Exchange India without directly dealing with cryptocurrencies. You can deposit and withdraw funds in INR, eliminating the need for crypto transactions. This means that all trading activity on Delta Exchange India can be conducted in INR, removing the direct association with crypto and simplifying tax complications.

Here's how:

Deposits:

- Log in to your Delta Exchange India account.

- Navigate to the ‘Add funds’ section.

- Add your bank account details in the ‘Add funds’ section.

- Once it gets whitelisted by the Delta Exchange India team, you can transfer funds to Delta India’s account.

Withdrawals:

- Log in to your Delta Exchange India account and go to the 'Withdrawal' section.

- Specify withdrawal amount.

- Add bank account details and select the correct withdrawal option.

- Confirm withdrawal by transferring the chosen amount.

Managing funds on Delta Exchange India is efficient and hassle-free with these steps.

INR-Settled Futures and Options

Users can trade futures and options on BTC and ETH with the convenience of settlement in INR. All Delta India contracts are quoted, margined, and settled in INR.

Tax-free trading

Since you never own cryptocurrencies when trading with Delta Exchange India, you're not subject to the taxes imposed by the Indian government on crypto traders.

Wrapping up,

Delta Exchange India is the country's largest and fastest-growing crypto futures and options (F&O) exchange. It has developed a crypto derivatives trading platform tailored for the Indian audience, cleverly avoiding crypto taxes and aligning with the proper regulatory support. They are delivering on their promises and shaping a favorable future for crypto in India.

Stay in the loop with Delta Exchange India by visiting our website for all the latest updates. Follow us on X and Instagram to stay connected. Don't miss out—download our app now from the Google Play Store!

No VCCircle/TechCircle journalist was involved in the production of this content.