Digitisation catapults Accenture among top MNCs in India with over $7 bn revenues

Accenture, a global technology services, consulting, and outsourcing company, planned to make its India operations one of the largest in the world nearly a decade ago. It was already a big name back then among multinational companies operating in India, but the firm has grown leaps and bounds since then.

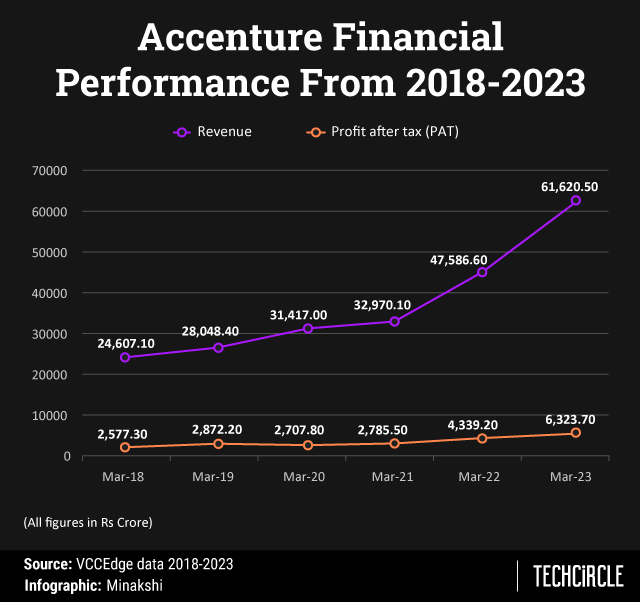

The growth level has been particularly sharp in the last two years. Although the growth rate last year moderated from 44% in the year ended March 2022, when it was boosted by the low base and pent-up client projects from the first year under the pandemic, at nearly 30% in FY23, Accenture crossed some other MNCs in terms of size in the country.

Indeed, Accenture is now believed to be the fifth largest MNC in India by revenues, behind Suzuki controlled Maruti, Samsung, Nayara Energy and Oppo. Last year, it went past FMCG major Unilever’s India unit Hindustan Unilever after having overtaken Korean carmaker Hyundai in FY22 itself, information compiled by data platform VCCEdge shows.

Notably, Accenture has nearly doubled in size in the last three years having ended FY23 with ₹61,620.50 crore or around $7.3 billion.

By net profit, it is now among the top fifty companies in the country having pumped out around $800 million in India last year.

Globally, Accenture revenue in the fiscal year ended August 31, 2023 grew 4% to $64.1 billion and 8% in Indian Rupees. Accenture’s net income at $7 billion was almost flat compared to 2022.

Accenture Solutions, the flagship Indian holding company largely provides service delivery capabilities to Accenture Group through its delivery centres in the form of software development and IT enabled services. It also provides consultancy services, which is under a tenth of the total revenue.

Over the years, the Irish-American technology firm has continued its efforts to hire and nurture the Indian talent pool as a key part of its growth plans and has undertaken various digital transformation initiatives.

Accenture declined to comment on this article, but the rapid pace of digital transformation projects around the world, including India, is believed to be the prime drivers of this growth. Services rendered to domestic clients in India, however, comprise a small proportion of roughly 8% of the total revenues, TechCircle has gathered.

For perspective, Accenture’s big domestic peers are bigger in size but not growing as fast and it is gaining market share from some of India's largest digital service providers, including Infosys, TCS, and Wipro.

Infosys, TCS and Wipro grew their rupee revenues by 20.7%, 17.6% and 14.4%, respectively, in the year ended March 2023.