How NTT’s India business got upended with a new show stopper

Japan’s NTT Group, one of the top tier providers of technology and business solutions globally with revenues topping $80 billion, has been going through its motions in India.

Three years ago, it said it is merging three business entities under Sharad Sanghi, founder of Netmagic, a VC-backed data centre company it acquired a decade ago. The group roped in former IBM executive Avinash Joshi as CEO of its India business early last year. Joshi was reporting to Sanghi, who remained the managing director of the operations. Sanghi was recently redesignated as chairman relinquishing his role as MD of the firm.

Meanwhile, even as NTT globally announced a merger of the IT services business of NTT DATA and NTT outside Japan into a new operating company, as of March 31, 2023 it continued to operate multiple entities in India, regulatory filings show.

What’s interesting is that the performance of two of its key local entities is a study in contrast.

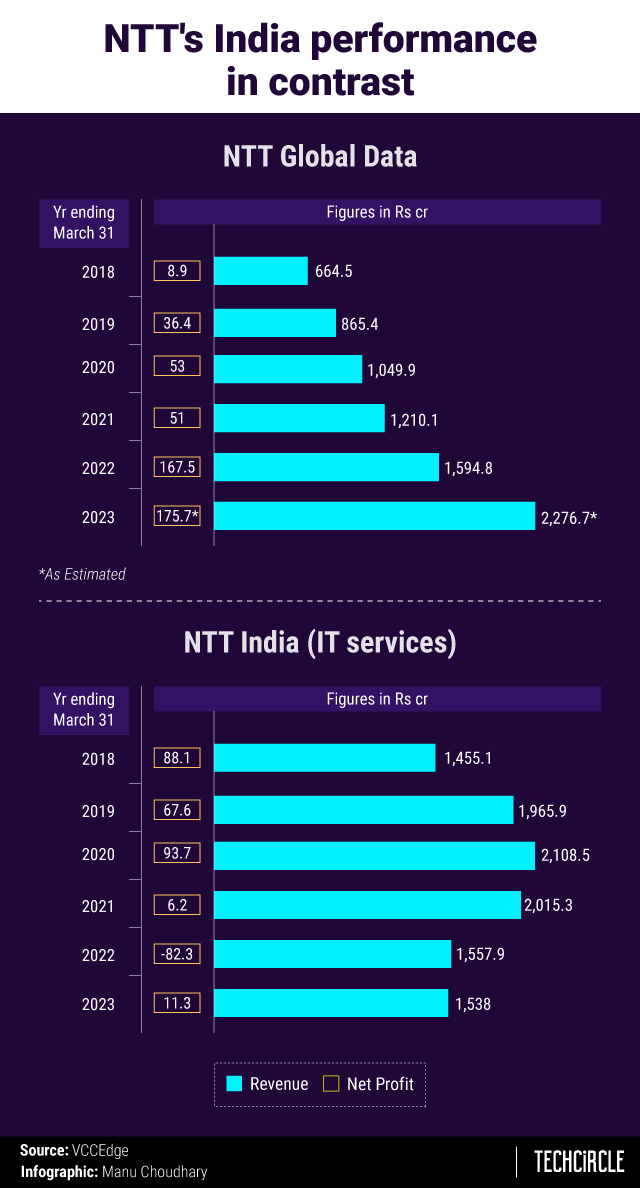

While NTT Global Data Centers & Cloud Infrastructure India Pvt Ltd (formerly Netmagic IT Services) which provides data centre colocation services, cloud services and dedicated hosting or managed services to customers across India has been on a high paced growth track, nearly quadrupling its revenues over the last five years, NTT India Pvt Ltd, has been shrinking.

Last year, around two thirds of NTT’s India revenues and nearly all of its profit came from the data centre & cloud operations.

NTT declined to comment on the business segments in India.

If one looks at only these two firms, factoring out any other smaller entities that NTT may be running in the country, data shows how the group’s India operations got upended. Data centre that comprised less than a third of the total income in India and under a tenth of its profit, has shot up in significance. In the year ended March 2023, the data centre arm contributed around three fifth of the total revenues and over 90% of its net profit.

Indeed, if the projected revenues of the year ending March 2024 is accounted for, the data centre is likely to be more than twice the size of its other sister company. NTT Global Data Centers & Cloud Infrastructure India is likely to cross Rs 3,000 crore topline mark in the current year.

Real estate consultancy JLL said in a report published 23 October that the growing digital public infrastructure, 5G rollout and use of new technologies like AI and Internet-of-Things (IoT) devices will add 693 MW of data centres in India between H2 2023 to 2026. Besides, data protection laws and state incentives signal a fresh set of demands emerging for the data centre industry, it said. This creates the right opportunity for NTT to leverage and scale up further.

Data centre business

Shekhar Sharma, CEO & Managing Director of NTT Global Data Centres and Cloud Infrastructure India, noted that the installed capacity in India’s data centres has more than doubled from 350 MW to 722 MW from 2019 to 2022, largely due to the widespread adoption of public cloud services and SaaS solutions by enterprises which is driving leading global hyperscalers to invest in data center capacity that can support these requirements.

NTT's data centre arm invested around Rs 2,700 crore last year and is currently in the midst of a $400 million capex programme in the current fiscal. At present, the company operates 16 data centers from 13 campuses across India, with several others at various construction stages. Its current capacity stands at 205 MW, which will grow to 349 MW by end of this year.

“Further ahead, we plan to add another 526 MW taking our total capacity to 875 MW in the coming years. Our strategic direction emphasizes the establishment of expansive data center campuses in primary locations and the integration of smaller Edge data centers in Tier-II and Tier-III cities throughout India,” according to Sharma.

He claimed that NTT commands a fifth of the market in India's DC sector. “By the sheer scale of their requirements, hyperscalers account for a major share in our revenue, but we have significant, longstanding engagements with several large and mid-market enterprises across BFSI, IT/ITeS, manufacturing and more,” Sharma said.

He sees a burgeoning demand for colocation data center services and public cloud solutions beyond traditional hubs like Mumbai, Chennai, and Bangalore. NTT has initiated the construction of a new data center campus in Kolkata and is in the process of establishing additional facilities in Chennai and Delhi.

Its expansion strategy also encompasses extending its reach to various Tier-II and Tier-III cities across India. The company has identified land parcels across Tier-II cities such as Pune, Ahmedabad, Jaipur, Lucknow, Bhopal and Chandigarh, among others. In fact, it is investing to develop data centers in Mumbai, Thane, Pune, and Nagpur, with the project expected to generate 1,500 jobs across all four sites.

On the key differentiators in the DC market, he said, NTT is India’s only provider to have interconnected data centers across the country. With the addition of MIST (Malaysia India Singapore Thailand) subsea cable system earlier this year, the firm is also able to connect its facilities in India to its global network via its Tier 1 Global IP Network.

This has further strengthened NTT's position as a key data centre provider in India and represents India's first cable landing of a 12-fibre pair capacity, capable of carrying more than 200 Tbps of data. This enhanced connectivity paves the way for increased data exchange and seamless communication across the region.

Overall, NTT employs more than 47,000 people in India across all its subsidiaries currently and is planning to onboard employees as it launches new data center campuses, subsea cable systems, renewable energy plants and research facilities.