AWS India net sales grow by about 43% in FY23

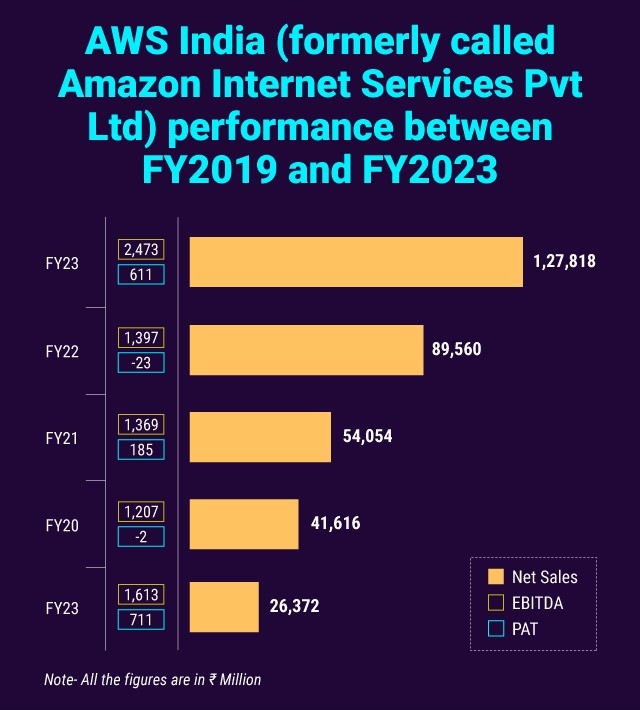

Amazon Web Services (AWS) India, formerly called Amazon Internet Services Pvt Ltd, started selling services in April 2016. In about a decade of its operation, AWS India has emerged as one of the top cloud players in the country. In FY23, AWS India recorded net sales of (₹12,781.8 crore, about 43% higher than ₹8,956 crore recorded in FY22, as per VCCEdge’s data.

The cloud company recorded a profit after tax (PAT) of ₹61.1 crore after recording a marginal loss of ₹2.3 crore in FY22. AWS India counts institutes and companies like Axis Bank, HDFC Life, and Acko among its customers.

“Indian enterprises and consumers are becoming more digitally native with a great demand coming from tier-2, -3 cities also. To cater to this, companies have no choice but to become cloud-native and bring to scale without compromising on either operational expertise, latency, or speed. AWS traditionally has been a leader, offering a large suite of services to consumers and enterprises. Additionally, artificial intelligence and machine learning also have a big role to play here,” said Akshara Bassi, senior research analyst, Counterpoint Technology Market Research.

This year, in an aggressive expansion move, AWS pumped up its investment in India, with a commitment of $12.7 billion or over ₹1 lakh crore into the country’s infrastructure by 2030 to meet customer demand. This follows the cloud company’s investment of $3.7 billion (₹30,900 crore) between 2016-2022, bringing its total investment in India to $16.4 billion. As per AWS, the latest investment in India’s data infrastructure is expected to create 131,700 full-time jobs in domains like engineering and telecommunications.

“Since 2016, AWS has invested billions of dollars into cloud infrastructure in India to support the tremendous growth we have witnessed in the use of cloud for digital transformation,” Puneet Chandok, the then president of commercial business, AWS India and South Asia had said. Notably, Chandok moved on from AWS to join Microsoft in August to lead the India business.

Further, on 14 September, AWS India announced that it received a nod from the Ministry of Electronic and Information Technology (MeitY) for cloud service provider (CSP) empanelment using the AWS Asia Pacific (Hyderabad) Region. After Asia-Pacific Mumbai region in 2017, this is the second AWS Region in India to be empanelled by the Ministry of Electronics and Information Technology (MeitY).

AWS competes with the likes of Google and Microsoft in the Indian market. While Google has two cloud regions, Microsoft has three in India.

As per market intelligence firm IDC’s 1 June report, the India public cloud services market, which includes infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) solutions, and software-as-a-service (SaaS) is expected to reach $17.8 billion by 2027, growing at a CAGR of 23.4% for 2022-27. This growth is attributed to the rapid pace of digital transformation during Covid-19 and the momentum is expected to be further supported by the adoption of artificial intelligence technologies, edge computing, and serverless computing, among others.