Spend-IT: Yes Bank’s IT budget buoyed 45% in FY23

Yes Bank, a Mumbai-based full-service commercial bank, saw a sharp jump in its information technology spending for the year ended March 31 as the lender is trying to digitise its network further and spruce up other units of its tech channels reach and cater to a wider set of customers.

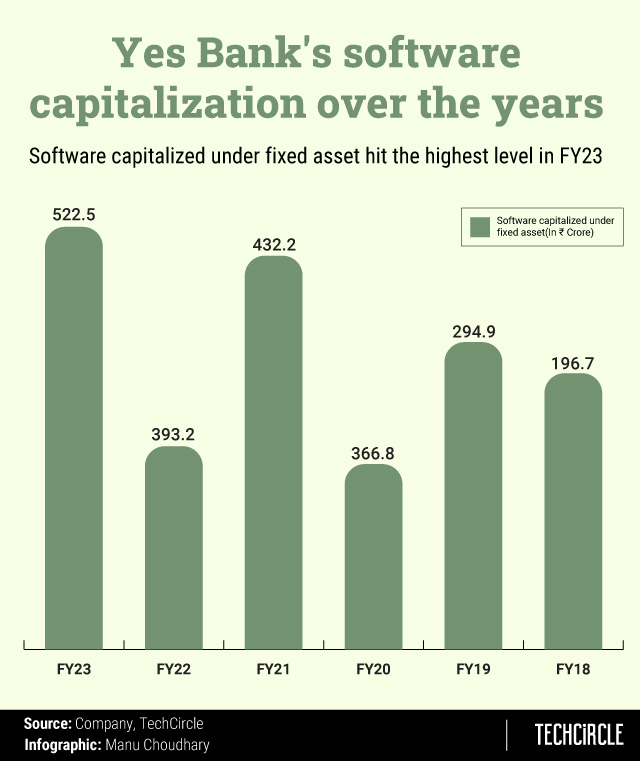

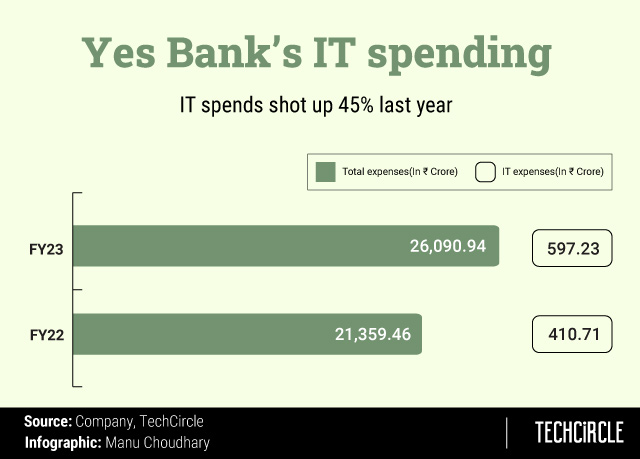

In particular, the total IT spends shot up 45% to nearly ₹600 crore even as broader investments towards technology/IT costs was pegged at ₹900 crore.

The firm counted API/micro-services; data & analytics; partner ecosystem; artificial Intelligence/machine learning; compliance and security as areas of focus under technology.

Last year, the bank launched a new 'YES for YOU' (HRMS) platform in partnership with Darwin Box — one of the fastest growing HCM technology platforms. The new platform enabled the employees to access information through a single cloud-based system (SaaS platform), provide them with a standardised and intuitive digital experience (on a mobile device or a computer).

Yes Bank said that it continues to be a leading player in new-age digital payments, including UPI, AEPS, NEFT, IMPS and NACH at 38.3%, 22.8%, 17.7%, 11.2% and 6.3% market share, respectively. It claimed that it processes nearly every third digital payment transaction in the country, which hovers between 10-12 billion on a monthly basis. To grow its digital volumes further and build resilience, the Bank has implemented cloud-native UPI, IMPS processors and alternate AEPS processors.

The lender also shared some new projects at work under Technology Transformation Office (TTO), which is under the direct supervision of the CIO.

In particular, nine transformational tracks are currently underway including notable ones like: Increase API Economy by monetising services; frictionless onboarding across bank channels, corporate clients & strategic partners; scalable cloud native platform that meets current & future demand; transparency to manage/monitor and agility for faster time to market; besides reusable soft assets across the enterprise.

Yes Bank has over the last three years imported technology from the likes of Salesforce, Crowd Computing Systems (WorkFusion), Swift, Murex, Adobe Systems, Informatica, Cornerstone OnDemand, Insightsoftware and MaxxTrader (Flextrade). Last year it also added Datametica Solutions as a vendor.

In the company’s annual report for the financial year ended June 30, Yes Bank noted that it has five data centres in Maharashtra and Karnataka.

In January, Yes Bank announced a partnership with Microsoft to leverage Azure platform to build a customer-service app. Running on Microsoft’s enterprise-grade platform, the new app offers services like online payments, banking functions, and customised dashboard.

To be sure, the bank also operates an omni-channel platform called Iris for cross-business applications including sales and customer support. It is a cloud-native platform that can handle up to 6,000 concurrent users.

Spending on IT by Indian banking and investment services is predicted to be a total $11.28 billion in 2023, a moderate increase of 2% from 2022, according to a report published in June by market research firm Gartner. Spending on IT software will see the largest growth with an increase of 10.5% in 2023, followed by IT services, which shows a 5% growth this year, the report stated.