'Experience and product far better customer hooks than deals in fintech ecosystem'

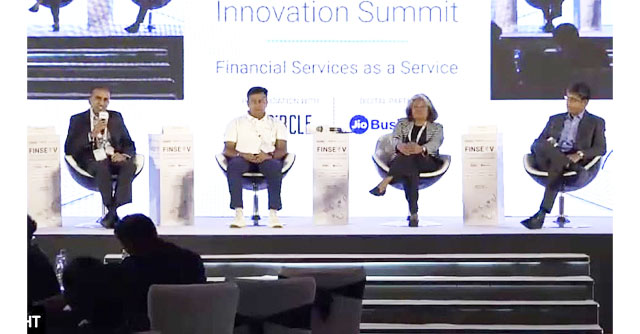

The evolution of financial services as an ecosystem in India significantly hinges on focusing on the experience and the product itself in terms of how appealing it is to a user — instead of using deals and offers to rope in users, opined a panel hosted on April 27 at TechCircle Finserv Innovation Summit.

Addressing the panel, Praveena Rai, chief operating officer of National Payments Council of India (NPCI), said that in order to create a tightly knit ecosystem of users who retain their usage of multiple services that are available in India, focusing on usage experience and the product itself would be key.

“Take a look at Unified Payments Interface (UPI), which today has proliferated everywhere, and is widely used by a large number of users across the country. The core reason behind this is the core usage experience that users would want to return to. Creating this stickiness would play a fundamentally bigger role in building an ecosystem of financial services, in comparison to simply offering deals and offers. The latter offer little user retention, and are generally short-lived,” Rai said.

The panel also touched upon the need to comply with regulations in the financial services sector — including why meeting regulations of the Reserve Bank is crucial for every entity in the fintech ecosystem, and why finding regulatory loopholes to create products and services may not be a sensible idea.

“We ensure that compliance with all regulations in the fintech sector are met with. To ensure this, we rope in external consultants who are subject matter experts, and have a full team of legislation and regulation experts who guide us on how to ensure that our product meets all the necessary laws of the land,” said Neeraj Chauhan, chief information officer at fintech firm, PayU.

Rai added that it is also important to ensure that startups do not necessarily look for “regulatory loopholes”, since that would make for “the wrong way to innovate in the fintech space, particularly for the long run.”

Technology service providers, too, concurred. Manoj Paul, managing director of data center operator Equinix India, said that the company has scaled its local storing and processing of user data to ensure regulatory compliance with “any potential upcoming regulations.”

“We have also built expertise in deploying data storage and processing in strategic geographies such as the European Union, who may reach out to another nation and offer strategically safe data locations for companies in such countries,” Paul added.

To be sure, India is expected to unveil a comprehensive Digital India Act in the near future, which could lay down further guidelines in terms of how companies may need to localize data for processing payments — both within the country and across borders. The RBI has already offered guidelines with regards to cyber security standards that banking and financial institutions will need to adopt in order to be sanctioned to operate in cross-border payments.

Ramganesh Iyer, partner at Bain & Co., moderated the panel.