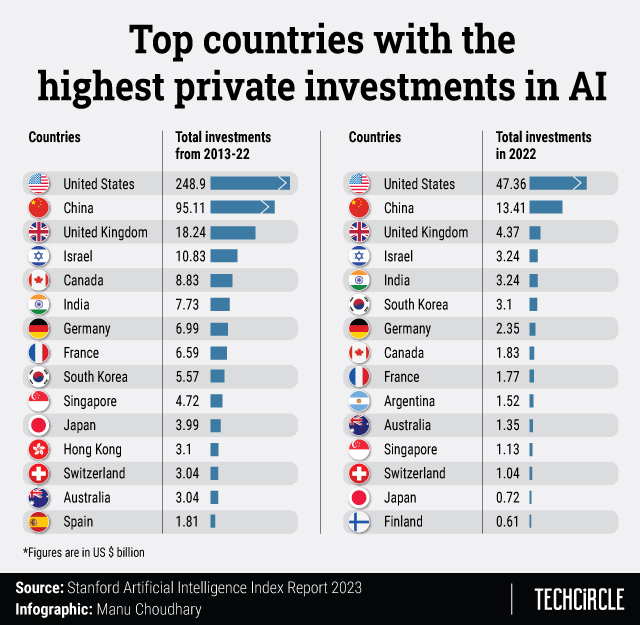

India ranks 5th in countries with most AI investments

India saw the fifth highest investments last year in startups offering artificial intelligence (AI) based products and services, according to Stanford University’s annual AI Index report. In 2022, the total investments in AI startups in India was $3.24 billion, which puts it ahead of the likes of South Korea, Germany, Canada and Australia. Countries that are ahead of India in the list include the US, China, UK and Israel.

The Index also shows that AI startups in India received total funding of $7.73 billion in the last decade, making it the sixth leading country with the most AI investments between 2013 and 2022. Nearly 40% of this investment was made last year.

Among India AI startups, last year Chennai based conversational AI startup Uniphore raised $400 million in a Series-E Round taking its valuation to $2.5 billion. Among this year’s biggest fund raises there is Chennai and US based AI startup Mad Street Den, which raised $30 million in a Series C round led by Avatar Growth Capital.

Though globally AI investment has declined since 2021 due to the economic slowdown, experts are expecting a revival in VC funding this year, especially due to the massive interest in generative AI products and OpenAI’s ChatGPT among enterprises and consumers.

“Given the unprecedented interest and the increasing industry sentiment that it is a step change in AI capabilities, I expect VC investments to gather pace in the coming quarters,” said Kashyap Kompella, an AI analyst and chief executive of research firm RPA2AI.

Aurojyoti Bose, lead analyst at GlobalData, also said that "long-term prospects are likely to be promising" and the rebound in both deals volume and value in Q4 2022 could be seen as an indication of it.

According to the findings of VC analytics firm Tracxn, investments in AI startups in India doubled from $1.7 billion in 2020 to $5.2 billion in 2022.

“The development and return on investment potential of investing in AI firms is very high. Despite the current funding winter and the economic slowdown, AI startups are expected to experience this upward trend in the coming years,” said Neha Singh, co-founder of Tracxn.

As reported by Mint earlier, several Indian firms like Flipkart and MakeMyTrip are exploring use of generative AI models in their products. Startups such as GupShup and Exotel have also announced chatbot builder platforms powered by OpenAI’s GPT models, which can be used by enterprises to build ChatGPT like chatbots.

Kompella pointed out that there are several startups in India that are building products on top of GPT models. “But a moat can be established only if there is something extra – for example a custom data source, like Bloomberg's FinanceGPT based on proprietary datasets, or an innovative RLHF fine tuning for specific use cases,” he added.

The Stanford report further shows that 54% of researchers working on large language models (LLMs) were from American institutions. However, last year researchers from Canada, Germany, and India contributed to the development of LLMs for the first time.

Kompella noted that building foundational AI models requires deep pockets but the financial returns are uncertain. He added that many of the AI startups are yet to figure out a business model.

“For example, Stable Diffusion is among the top three image generative AI tools, along with OpenAI’s Dalle-2 and MidJourney. But despite that, it appears that Stable Diffusion is struggling to find a profitable business model. AI units of large tech firms and leading companies like OpenAI are all in the heavy investment phase, not in the generate profits stage,” said Kompella.