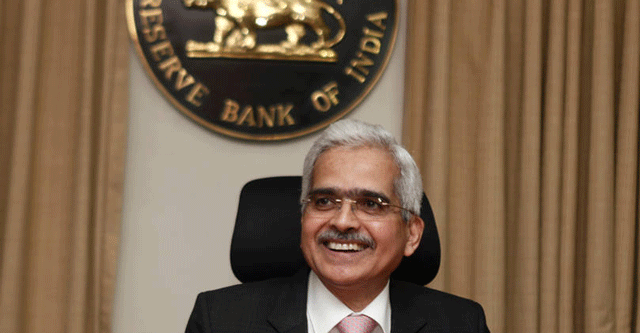

Crypto will cause next financial crisis: RBI Governor

The next financial crisis will come from private cryptocurrencies, Shaktikanta Das, governor, Reserve Bank of India (RBI), said today while speaking at the Business Standard BFSI Insight Summit. He added that cryptocurrencies pose a risk to macroeconomic and financial stability, and said that he is yet to hear about what public good cryptocurrencies have served. He also called it a ‘100% speculative activity.’

“After looking at the latest episode of FTX. I don't think so we need to say anymore," Das said.

Further, Das also spoke about the difference between the unified payment interface (UPI) and central bank digital currency (CBDC). He said that CBDC is a currency, unlike UPI which is a payment system that requires the intermediation of banks. Calling it the currency of the future, Das said that CBDC is inexpensive unlike printed notes, and allows instant money transfer between two countries.

He also said that the underlying economic activity in India continues to be strong but external factors will cause some dent in the economy. RBI tracks 70 fast-moving indicators and most of them are in the green box, he mentioned.

Speaking of private cryptocurrencies, this is not the first time Das has made strong comments on this topic. In June, he called cryptocurrencies a ‘clear danger’, adding that anything derived value on make-believe is without any underlying, is just a sophisticated term for speculation. Before that, in February, Das asked people investing in cryptocurrencies to do so at their own risk.

“These digital assets undermine India’s financial and macroeconomic stability because of their negative consequences for the financial sector. Further, a wider proliferation of cryptocurrencies has the potential to diminish monetary authorities’ potential to determine and regulate monetary policy and the monetary system of the country which could pose a serious challenge to the stability of the financial system of the country,” RBI had said in concept note on CBDC.

In November, RBI rolled out the Digital Rupee pilot project for the wholesale segment. This was earlier announced at the 2022 Union Budget presentation by finance minister Nirmala Sitharaman. The Digital Rupee is different from other cryptocurrencies since it is backed by the government and thus has an intrinsic value.