Former Razorpay executive returns to firm as CIO after stint at NPCI

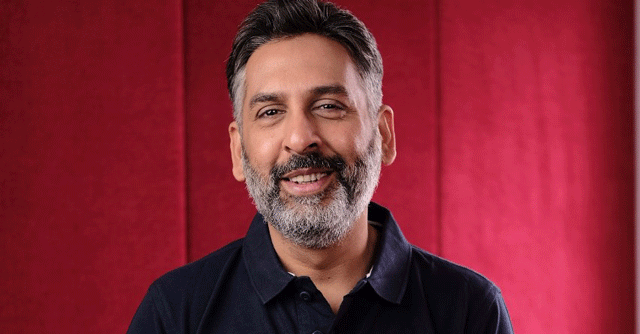

Payments gateway platform Razorpay, on Tuesday announced that former official Arif Khan will return to the company as chief innovation officer (CIO), after a nearly 3-year tenure at the National Payments Corporation of India (NPCI).

In his role as the CIO at Razorpay, Khan will lead the banking, risk management, regulatory affairs and public policy teams.

“During his previous stint with us, he played a crucial role in establishing several foundational pillars of our banking capabilities and nurtured relations with various external stakeholders. With Arif on board, we look forward to creating differentiated products for digital businesses and their consumers,” said Harshil Mathur, co-founder and chief executive officer, Razorpay.

According to a release, Khan will be leading engagement with banks, networks, regulators, and strategic partners to drive innovation at Razorpay as well as accelerate the adoption of new payment and banking platforms and products.

With more than 2 decades of experience in banking and financial services, Khan has worked with organizations such as MasterCard and HDFC Bank, among others.

At NPCI, Khan has worked as the chief digital officer, leading strategic planning in relation to the digital transformation of the organization.

Having joined Razorpay in 2017, Khan left the fintech unicorn in 2019. Prior to Razorpay, he was the senior business leader at MasterCard where he was responsible for the growth of the payment gateway platform. He also led the growth of Mastercard’s ‘Simplify Commerce’ platform.

He has also worked as senior vice president at HDFC Bank on strategic projects in the payments and digital space. In total, he was associated with HDFC Bank for 15 years.

Khan’s appointment comes at a time when the fintech major has just entered into the offline payments segment by acquiring a point-of-sale (PoS) payment platform, Ezetap.

Razorpay said that his role will be crucial in standardizing operations, improving efficiency, and expanding the company’s solutions suite for the offline payment landscape too.