Uber says profitability in India biz not too far away

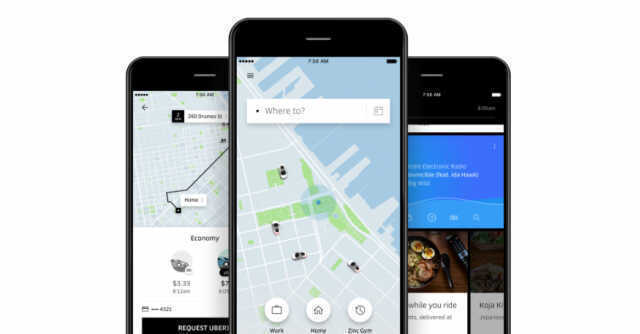

US ride-hailing platform, Uber, says it expects India to become a high-growth yet profitable market soon. Pradeep Parameshwaran, the company's regional general manager for the Asia-Pacific region, said the company sees heavy demand in the country and the low penetration of ride-hailing in India, which it hopes would translate into more opportunity.

“It’s a steady march. Every year our unit economics are doing better than the previous year. We don’t have an exact timeline to be profitable in India. But I’d say it’s not that far away either,” Parameshwaran told a section of the media in an interaction in Sydney last week, even as he dissed rumours about possibly exiting the country or merging with competitor Ola.

He added that pre-Covid, the category of people who could afford Uber’s services was growing at 15-20% in India. Parmeshwaran pointed out that ride-hailing penetration is 0.3% in India, which is just one-tenth of the penetration numbers in markets like the US. “Frankly, we have runway for the next decade plus (with respect to demand),” he said. “Our unit economics have improved dramatically in the last three-four years. I feel very good about where we are on that journey, and over time I have no doubt that India will be a high-growth market which will also be profitable,” he said. “But right now, we are in the investment phase, like intercity, high capacity vehicles (HCV), we have to spend on marketing, technology, and customer care and more,” he added.

Globally, the company reported its first-ever cash flow positive quarter in its 13 years of existence for the June quarter. While Uber reported a net loss of $2.6 billion for the second quarter (of which it attributed $1.7 billion to investments and revaluation of stakes in Aurora, Grab and Zomato), it posted $382 million in free cash flow. Total revenue for the June quarter stood at $8.07 billion (Uber does not provide separate country figures).

It sees India as a long term investment and is looking to push two and three-wheeler products in the country.

According to a report by Public First commissioned by Uber, earnings for driver-partners and indirect effects, like maintenance of cars, etc., created economic value worth Rs.446 billion in India in 2021. The report also estimated that Uber created a consumer surplus of Rs.1.5 trillion in India last year.

According to Paremeshwaran, expanding the modes of transport and improving service quality, which has declined due to shortage of drivers and high-fuel costs post pandemic, is among the chief concerns for the company right now. Uber Moto and Uber Auto, which offer rides on motorbikes and auto-rickshaws, are among the fastest growing segments for Uber in India. However, the company said that expanding to the two- and three-wheeler markets has been difficult for the firm. “On three-wheelers, some states are outright saying that your licence doesn’t apply. So we’re stuck in bureaucratic knots, which are inefficient,” Mike Orgill, Senior Director, Public Policy and Government Relations, APAC at Uber, told Mint. He added that safety concerns and the issue of “can you transport somebody on something that’s not a commercial vehicle” have affected the Moto business.

Orgill also said that Uber has “encouraged” the government to open up the ride-hailing space to everyone, so that anyone can drive cars on platforms like Uber, without commercial licences as long as they meet the safety standards and pay the right taxes commensurate with the activity. He added that rules and regulations India applies to two- and three wheelers could impact countries in Latin America, the Middle East, South America and other places where such transport is common. The country’s Code on Social Security, 2020, also sets it ahead of others in terms of creating labour laws for gig workers, according to Uber.

“We want outcome focused regulation, so that if we start to see better ways to do things with technology, we’re happy for the government to take a look at it and figure out if it’s good or not,” Orgill said. “What we’re trying to get to is, say what is it that you’re really trying to get to in terms of safety, customer protection, driver welfare outcomes, and how do we set those as goals versus being prescriptive in terms of how you do it. Because once you’re prescriptive, we’re locked in to doing it as prescribed, and the government basically is running the business when we feel like there’s technology that we could be taking advantage of,” he said.

Lastly, the company said it wants to deploy more electric vehicles (EVs) in India in the coming years. While it does not have any electric vehicles in the country, Uber has pledged to have an all-electric fleet globally by 2040.

(Note: The writer was in Sydney, Australia, to attend a press event sponsored by Uber).