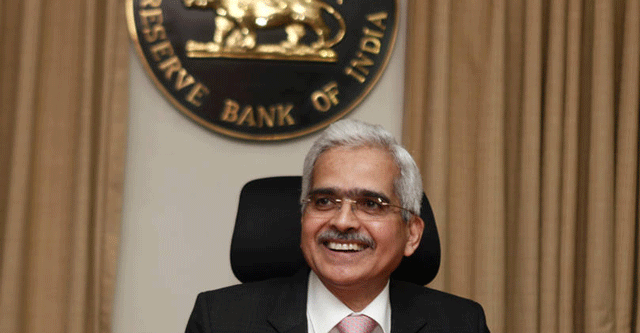

Digital lenders should stick to businesses they are licensed to do, says RBI Governor Das

Digital lenders should operate within the guardrails of regulatory guidelines and adhere to the specific licences granted to them, Reserve Bank of India (RBI) governor Shaktikanta Das said on Friday.

“The firms should operate under the licenses granted to them. If they are doing anything beyond that then they should seek our permission. Without permission if they are engaging in activities for which they have no license then it is not acceptable,” Das said at Bank of Baroda’s annual banking conference.

Das said that RBI cannot allow risk to be built up in the system and added that within the next few weeks, it will release the much-awaited digital lending norms. According to Das, the central bank wants to support innovation and, at the same time, wants the entire ecosystem to grow in an orderly and regulated manner. The regulations has been delayed because of the complexity of the situation. The regulator has to support innovation, while maintaining financial stability, he said.

“...we are dealing with the large number of unregulated, unlicensed entities which are doing various kinds of lending. There are licensed entities also which are entering into activities which they are not supposed to undertake,” he said.

The regulator, Das said, has formed a committee, whose recommendations have been examined. “Our responsibility is to maintain financial stability. The firms should operate under the licenses granted to them. If they are doing anything beyond that then they should seek our permission. Without permission if they are engaging in activities for which they have no license then it is not acceptable,” he said.

In November last year, the committee set up by the central bank suggested reining in digital loan apps through a mix of regulations, including setting up of a nodal agency to verify their credentials and legislative measures to prevent “illegal lending”. The thrust of the report was on enhancing customer protection and making the digital lending ecosystem safe while encouraging innovation.

RBI had constituted a Working Group (WG) on digital lending including lending through online platforms and mobile apps headed by its executive director Jayant Kumar Dash. As per the findings of the committee, there were approximately 1,100 lending apps available for Indian Android users across over 80 application stores between 1 January and 28 February. Of these, 600 are illegal, the panel found.