Semiconductor manufacturing a $85-100 billion opportunity for India: IESA

Despite trying and failing many times, the Indian semiconductor industry believes that the country could gain a significant portion of the global supply chain. According to a report published by the Indian Electronics and Semiconductors Association (IESA), the country could emerge as one of the leading suppliers of materials, equipment and services in the global semiconductor space by 2030.

The report, titled Global Semiconductor Manufacturing Supply Chain Report, claims that India could account for $85-100 billion out of a $550-600 billion annual global market opportunity by 2030. In a second report, titled India Semiconductor Market Report 2019-2026, the industry body claimed that the Indian semiconductor market could grow to $64,050 million by 2026, and the market was valued at $27,154 million in 2021.

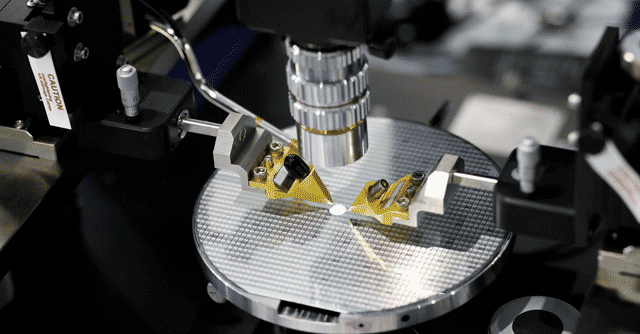

According to Rajeev Khushu, chairman of the IESA, semiconductor manufacturing in India will include both assembly, test, marking and packaging (ATMP) plants and fabs. “The government has already announced that they have shortlisted semiconductor and display fabs. There will be more of these that will come to India. If a fab is announced today, it will take three years for the first product to come out of it,” he said.

The India Semiconductor Market report segmented the global semiconductor market into three parts, including manufacturing of semiconductor equipment used in the fabs, foundries and TMPs, materials such as chemicals, minerals, and gases used in the manufacturing process, and services across the semiconductor manufacturing value chain.

The report noted that some of these raw materials are already manufactured in India. They are just not meant specifically for semiconductor manufacturing right now.

To be sure, Khushu and IESA aren’t the only ones confident of such growth. “I wrote the first paper for the government in 1999, for starting semiconductor fabs. But every time there were detractors within the government, and outside it,” said Ajai Chowdhry, founder of HCL. “People don’t understand that some day you will be in serious trouble geopolitically,” he added.

Chowdhry and a group of veterans from the Indian electronics industry formed a non-profit organization called EPIC Foundation last week, which aims to produce Indian products and brands for electronics.

The group includes HCL founders Chowdhry and Arjun Malhotra, along with semiconductor industry veteran Satya Gupta. EPIC Foundation has also signed memoranda of understanding with the government of Delhi, and Indian Institutes of Technology in Kanpur and Madras. It seeks to create a $45 billion market for Indian electronic products.

To be sure, Gupta said that the group doesn’t plan to go to the leading edge of the industry just yet. Instead, it plans to start with the smaller fabs, which cost around $3-4 billion using benefits from the government’s $10 billion production-linked incentive (PLI) scheme, announced earlier this year.

“It makes sense to start with 28nm now and then move to higher technology later. As of now, India mostly has R&D labs with an output of 4,000 wafers per year, which is very small,” said Khushu. He said that while the government hasn’t stopped anyone from bringing advanced chip designs into the country, the IESA has been recommending starting with 28nm plants.

“If someone wants to set up 9nm fabs, they can if they get approval from the government. But it won’t be easy as there will be a lot of heavy lifting involved in making it work. A 28nm fab will be straightforward and quick. Also, most of the chip requirements in automobiles by the Internet of Things (IoT) will be covered by 28nm design,” he added.

In the Global Semiconductor Supply Chain report, IESA noted that only 9% of India’s semiconductor components were locally sourced in 2021, but it is expected to grow to over 17% by 2026.

The IESA also signed an MoU with the Semiconductor Industry Association (SIA) of the United States, to help strengthen the ecosystem in India, last week. John Neuffer, president and chief executive officer of SIA, said that the MoU will help the SIA “establish and build relationships” with key stakeholders in the country at the time.

With input from Prasid Banerjee