upGrad raises $120 mn in first external funding round

Mumbai headquartered upGrad Education, which runs an eponymous edtech platform, has raised $120 million (around Rs 900 crore) from Singapore based sovereign fund Temasek.

This is the edtech major’s first external round of funding since its inception in 2015.

upGrad plans to use the fresh capital to strengthen its team, scale global market operations, bolster technology and product capabilities, pursue merger and acquisition (M&A) opportunities, expand graduate and post-graduate degree portfolio in India, and scale up operations to achieve its $2 billion revenue goal by 2026, a statement said.

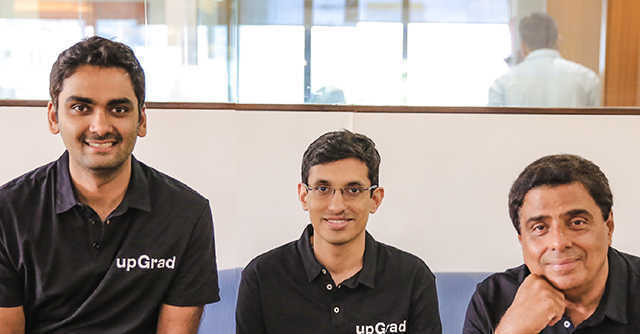

"This capital will further fuel our commitment towards global expansion as well as deeper India penetration, as we march forward with our goal of making India the teaching capital of the world,” upGrad co-founders Ronnie Screwvala, Mayank Kumar and Phalgun Kompalli said in a joint statement.

Credit Suisse acted as the exclusive financial advisor to upGrad for the deal and Rajaram Legal was the legal advisor.

upGrad recently raised capital from Screwvala-run Unilazer Ventures, a Mumbai based private equity and venture capital firm.

In 2020, upGrad grew 100% in revenues and tripled its course offerings with three acquisitions.

It recently partnered with Israeli firm EyeWay Vision to enable enhanced augmented reality (AR)-driven learning experience.

The edtech firm said that its annual revenue run rate (ARR) for financial year 2020-21 (FY21) touched Rs 1,200 crore($165 million at the time). The company had an average revenue per user (ARPU) of Rs 2.5 lakh.

With a presence in over 50 plus countries, upGrad currently offers more than 100 courses in collaboration with global universities such as Deakin Business School (Australia), Duke CE (US), Michigan State University (US), Liverpool Business School (UK), IIT Madras (India), and IIM Kozhikode (India). The company claims to have impacted over 1 million total registered learners over 50 countries across the world.

Investor Temasek has a net portfolio value of $214 billion, as of March 31, 2020. Its recent India investments include those in epharmacy company PharmEasy, online food delivery platform Zomato, and sensory sciences startup Tastry.