Tier-I IT services firms regain strength in a seasonally weak quarter

Record high contract values, best quarters in considerably lengthy time periods, profit jumps, growing digital service line revenues, and a healthy dash of global captive unit deals -- that has been the story at the Indian IT (information technology) services sector in the quarter ended December 2020.

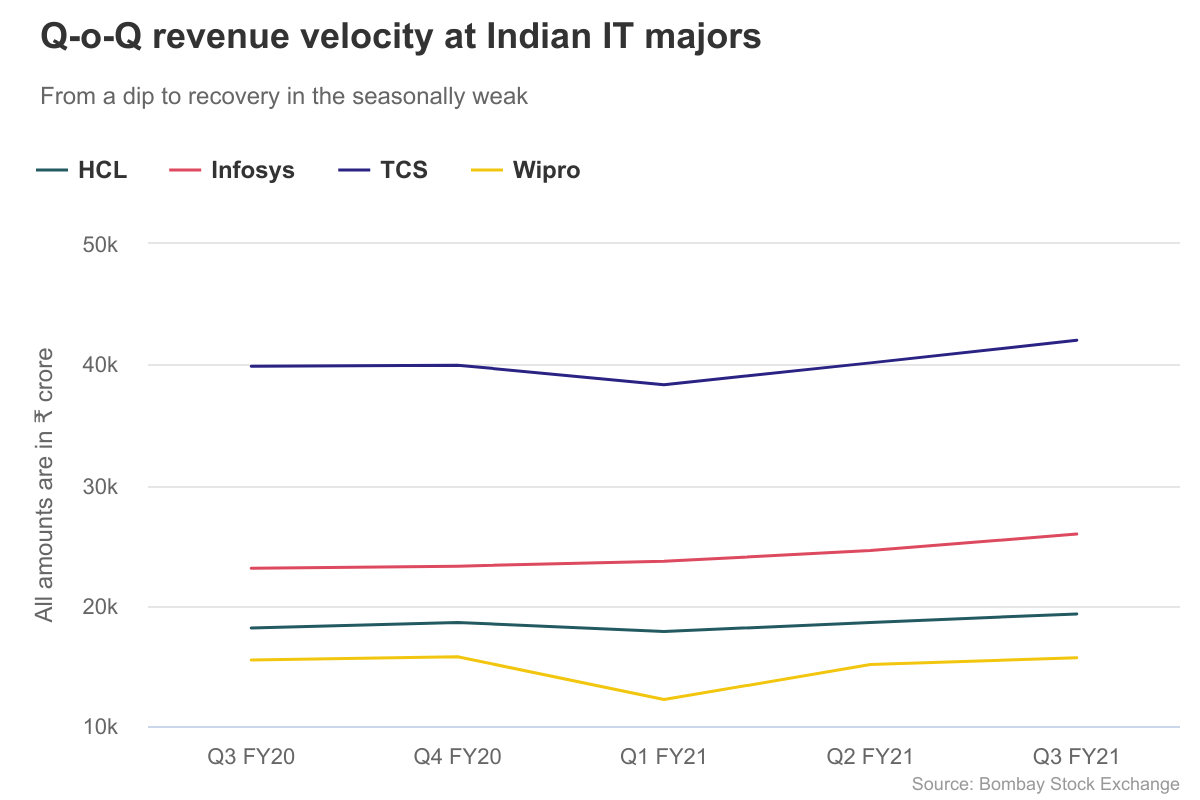

TCS, Infosys, Wipro, and HCL -- the top four players in the Indian IT services market -- saw a dip in revenues in the first quarter (Q1) ended June 2020 and a recovery in the seasonally weak quarter of Q3.

The effects of Covid-19 have pretty much remained consistent for the big four.

TCS does not forecast revenues. After CEO Rajesh Gopinathan foresaw a global financial crisis-like dip lined up in Q1 ended June 2020, the Mumbai-headquartered company started to report results to analysts on a sequential basis.

The four multi-billion dollar firms vie for the same markets, chiefly North American and European, with the same set of geopolitical factors and economy that come along. Yet, each company’s management has demonstrated confidence in addressing a broken demand-supply chain in a watershed year for the $147 billion Indian IT services exports industry.

TCS had started Q4 FY20 with a thesis on the then existing softness in banking, financial services and insurance (BFSI) and retail industries. The $22.03 billion IT services firm had anticipated clients shoring up enough capital to sign on bigger deals in the future, but client budgets were shrinking in the immediate term. Then, a pandemic was declared.

Against the backdrop, Q3 FY21 was glitzy for a variety of reasons. It took four quarters for management confidence to return on broad-based growth across verticals, sequentially.

The target, a pragmatic Gopinathan had set, was for TCS to reach back to Q3 FY20 levels in revenue terms. Supply-side crunch met demand-side mutedness. Impact in Q4 was about two-third supply and one-third demand at TCS. By Q1, it was peak crisis, across industry, with lower utilisation, further retail business downturn, and near-term volatility.

“The next target is the margin. We are at 25% this quarter. There is no way this is going to get defended in the near-term,” Gopinathan said in April. “But our intent is to get back to this level, and our current modeling is to be able to get back there by Q4 of FY21, so that we can start off where we left.” TCS reported an operating margin of 26.6% in Q3.

However, a rival whose revenue dip and recovery looks most distinct as a recession-mannered recovery on the chart -- alphabet V-shaped in geometrical terms -- was $12.8 billion Infosys. Last year, CEO Salil Parekh had also anticipated concerns in an “extremely difficult” business environment. Forecasts fail pandemics.

To sustain margins within the 20% club, Infosys froze hiring, hikes, and promotions. But only a good top-line growth adds value to otherwise good operating margins.

Given the control on the dip and subsequent recovery, in rupee revenue terms, either Parekh is a wizard who knew all about Covid-19 before the Chinese, or he’s particularly meticulous about numbers. There is no third possibility.

Digital revenues share, a metric that TCS has stopped to offer, at Infosys went from 40.6% in Q3FY20, 42.0% in Q4FY20, 44.5% in Q1FY21, and 47.3% in Q2FY21, to over 50% in Q3FY21.

Infosys’ total contract value (TCV) went from $1.8 billion Q3FY20, $1.65 billion in Q4FY20, $1.75 billion in Q1FY21, and $3.15 billion in Q2FY21, to $7.13 billion in Q3FY21.

In the same period, the TCV at larger rival TCS went from $6 billion Q3FY20, $8.9 billion in Q4FY20, $6.9 billion in Q1FY21, and $8.6 billion in Q2FY21, to $6.8 billion in Q3FY21.

Read: Where the new deal wins for TCS?

Infosys’ Cobalt launch seems to have Trojan Horse-d the pandemic. Analysts at Emkay Research now expect Infosys’ valuation gap with TCS to narrow down further on the back of sustained strong operating performance. Infosys has outperformed TCS in the last few quarters. The EBIT margin gap between Infosys and TCS is also narrowing.

“What we are seeing, what that's demonstrating to us is, the client buying is more and more in the digital area. Our business in the cost services is extremely strong and competitive, and we believe that even here, we have a situation where we are ahead of where some of our peers are. But the spending with clients is not focused on digital, and with our reorientation investments and market connections in digital with our partners and with our clients, we start to see some benefits where digital is growing and therefore helping the overall company,” Infosys CFO Nilanjan Roy told analysts.

Sharing the Electronic City neighbourhood, $8.1 billion Wipro seems to be dipping and growing at its own pace, almost oblivious to fierce competition at TCS and Infosys.

Wipro won 12 deals, making up a TCV of $1.2 billion in Q3, which included the METRO captive deal of $700 million. “(The) consumer sector continues to trail blaze on the back of solid deal wins,” Wipro CEO Thierry Delaporte said. “Growth in financial services is driven by demand across pretty much all sub verticals, led by demand in digital operations primarily; cloud infrastructure services also and digital transformation.”

The company has unveiled a new structure for its service lines. EBIT margin at the company came at 22 quarters high at a sharp 21.7%, as per analysts at Prabhudas Lilladher.

The situation at Wipro remains unclear. New service lines or not, it has to balance out the wage hikes for 80% of employees that’s likely to be carried out in Q4, not to forget restructuring costs.

Read: How Thierry Delaporte is re-building Wipro’s growth engine

If the recent deal win with Italian automobile giant Fiat Chrysler Automobiles’ unit in India is of any indication, tides at the company may turn soon.

Another rival, $9.94 billion HCL, does not report TCVs. However, it too rode its sequential recovery on the back of digitisation at corporates in the wake of contact-less and heightened consumer and employee experience. The company calibrates digital growth through its ‘Mode 1-2-3’ strategy.

Mode 2 and 3 which contains service offerings of digital, analytics, Internet of Things, and other such cloud native services, and products and platforms respectively, drove Q3 momentum.

At the analysts call, head of the company’s digital and analytics practice Anand Birje said that enterprises have accelerated digital transformation activities almost multifold that show across value chains—customer engagement, partner engagement, employee engagement, omni-channel transformation, both online and offline commerce; supply chains that include planning, logistics, last mile delivery, new products; and the ability to launch into products in new markets faster.

The tier-I IT services firms from India are on the right path to capitalise on enterprises waking up to transformation because of the pandemic. To be fair, the lot prepared well.