RIL stocks rally; BSE seeks explanation on proposed Reliance Retail, Amazon deal

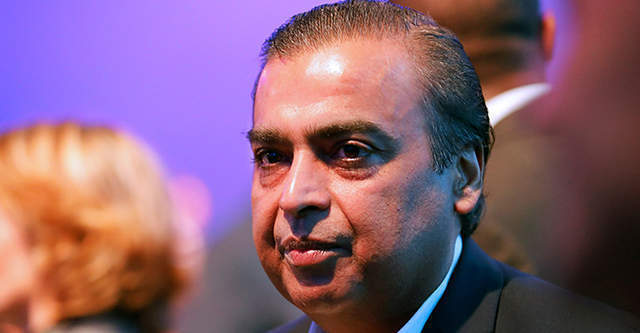

Mukesh Ambani-led Reliance Industries (RIL) became the first listed Indian company to cross $200 billion in market capitalisation, with the RIL stock closing 7.10% higher at Rs 2,314.65 on the Bombay Stock Exchange on Thursday.

The rally came on the back of a report by wire agency Bloomberg, which said that the company proposed to sell a 40% stake in its subsidiary Reliance Retail Ventures (RRVL) to Amazon for $20 billion.

Reliance’s retail arm recently raised $1.02 billion from private equity firm SilverLake at a pre-money valuation of $57 billion.

The stock exchange sought a clarification from RIL with reference to the Bloomberg report dated September 10, by 2 pm.

After the end of the day’s trade, RIL responded with, “We would like to reiterate that as a policy, we do not comment on media speculation and rumours and we cannot confirm or deny any transaction which may or may not be in the works.”

“Our company evaluates various opportunities on an ongoing basis. We have made and will continue to make necessary disclosures in compliance with our obligations under Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 and our agreements with the stock exchanges,” the statement read.

On August 29, RRVL had announced the acquisition of retail, wholesale, logistics and warehousing businesses of Kishore Biyani led Future Group for $3.38 billion.

JioMart, Reliance’s online grocery delivery business, fashion and lifestyle ecommerce platform Ajio, and a network of over 12,000 retail stores, including Reliance Retail, are a part of RRVL’s business.

During its general meeting in July, RIL had said it was looking to raise capital for its retail arm RRVL on the lines of its Jio Platforms business.

Jio Platforms has so far raised nearly $21 billion (Rs 1,52,056 crore) from a clutch of strategic and financial investors, including Facebook, Google, Vista Equity Partners, General Atlantic, KKR Mubadala Investment Company, Abu Dhabi Investment Authority, L Catterton, TPG Capital, Intel Capital and Qualcomm.