This Mumbai born startup wants to take the pain out of equity investing in private cos

Why do good ideas fail? It’s a question that nearly every startup founder and venture capital investor has asked herself or himself at some point, maybe even multiple times. Former hedge fund manager Nandini Sankar asked herself the same question, not too long ago.

“Lots of good ideas fail simply because people run out of cash. If you happen to ask a startup founder who you just met about his current burn rate or projected burn rate in 2-3 months, I guarantee he wouldn’t be able to give you an answer. This is super important. When cash becomes scarce, this becomes a very important question to answer,” says Mumbai based Sankar.

Sankar didn’t stop at pondering why so many good ideas fail. She decided to find a solution which eventually led to TOPPEQ, a six-month old venture that is building tools to help founders and equity investors manage their working capital and cap tables better.

Managing capital is something Sankar, 45, understands intimately.

Prior to TOPPEQ, the Chennai-born entrepreneur spent nearly 20 years years criss-crossing the global financial markets. As former managing director for the Asia Pacific region at Windsor, Connecticut headquartered hedge fund administration firm SS&C GlobeOp, she was in charge of the company’s India operations including sales and P&L management. She was director of technology at London and New York-based GlobeOp Financial Services before the company was acquired by SS&C. Earlier, she was also associated with Greenwich, Connecticut headquartered hedge fund Long Term Capital Management, where she was responsible for its credit exposure and treasury management applications as the technology strategist.

After transitioning out of SS&C GlobeOp in early 2017, Sankar spent a little over two years developing and executing a pension plan for domestic workers called okGita. The venture sought to encourage domestic workers to save a portion of their salary and employers would match those savings with a contribution. The employer's contribution would become vested over time. The aim was to create a provident fund product for blue collar professionals such as household help, chauffeurs and other staff.

Sankar continues to run OkGita alongside TOPPEQ.

Around November last year, Sankar and her team of 21 people, chiefly senior business analysts and chartered accountants with an average work experience of over 10 years, started to build TOPPEQ. Demos of the minimum viable product (MVP) started in April and Sankar claims to be in advanced talks with half a dozen initial clients.

“Startups, venture capital firms, law and accounting firms are going to take us from MVP to beta. We want to shut it off at a dozen and when the beta product is ready in September, we will start to actively sell the product,” she says.

What’s under the hood

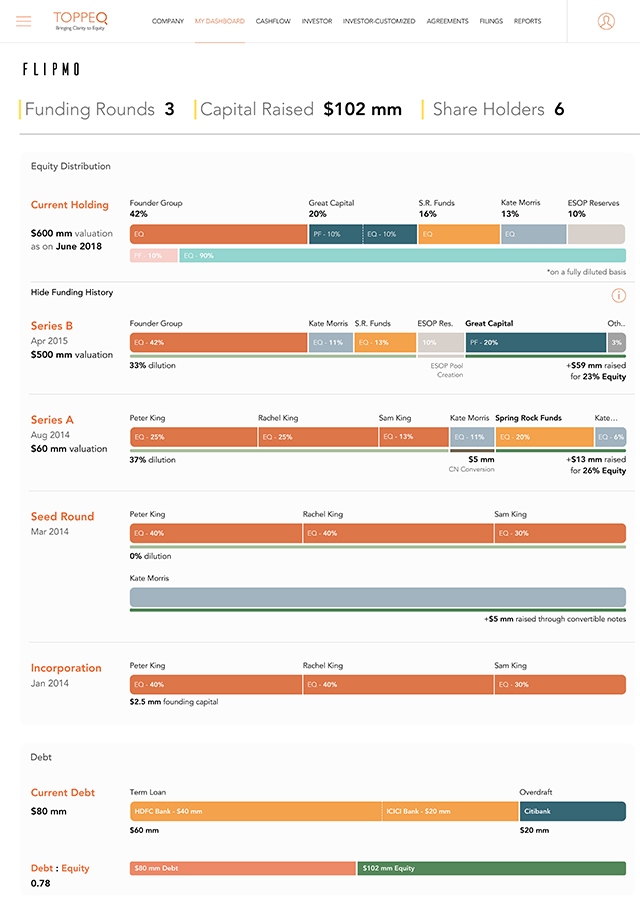

In a nutshell, TOPPEQ is a SaaS platform that aims to be a one-stop shop for cap table, working capital, and employee stock ownership plan (ESOP) management services. In addition, it will provide electronic share certificates and professional services support with agreements and regulatory filings.

For startups, the platform becomes an easily accessible and manageable repository for its shareholder information. Working with a large ensemble of data ranging from basic shareholder details down to the types of securities held by each shareholder, it simplifies, digitises and secures the equity data; enables access instantly from anywhere, and helps them maintain a clean cap table. The system red flags contractual trapdoors, helps ensure parity between all parties, and sets a regulatory calendar to remind them of required filings.

On the cash flow management front, the voice and messaging based digital expense ledgers help startups track current spends while the artificial intelligence (AI) based forecasting tools enable them to create a financial road map, aiding informed expense and revenue decisions.

As a result, entrepreneurs are able to remain on top of their cash flow and burn rate and anticipate when to start the process for the next fundraising round.

“If you have interest from a venture capital firm (for investment), you can give him a link and get the due diligence done in the TOPPEQ ecosystem because everything, your cap table information, cash and working capital information, regulatory filings, sit in one place. It takes away the pain of evaluating hundreds of emails and documents,” Sankar explains.

Like startups, investors, specifically venture capital firms, also stand to derive efficiencies with respect to the dealmaking process via the TOPPEQ platform. Investors rely on metrics that are specific to each investment. TOPPEQ evaluates the different variables and does scenario modelling to help investors build their own metrics dashboard. The AI platform eliminates human bias, evaluates each variable and their variants and enables investors to pull up the metrics that really matter to them.

Further, they cut down the time taken up by manual compilation of data required to take investment decisions.

“From burn rate, cash runway, top expenses and agreements, everything is going through tremendous churn. Startups and investors are spending time and money on an ongoing basis to figure out the various operational elements and legal nitty-gritty to protect their interests. We can provide that information faster and in real-time, which will help lawyers work more efficiently,” she says.

The platform offers a bird’s eye view of cab tables, which includes a startup’s funding history, shareholder details, types of shares, dilution details, valuations, and a messaging board about upcoming corporate events including board meetings and cumulative convertible preference share (CCPS) conversions.

The company has also developed a legal dictionary, offering a Google-type interface for shareholder agreements that help startup founders understand legal agreements better.

“Let’s say you are going through a down round (a funding round with a lower share price than received in the previous round). You want to know how many of your investors have anti-dilution rights that you need to worry about. It’s not an easy task for a founder to figure such things. We are trying to create an environment where that information is literally at your fingertips,” Sankar says.

With its data repository, TOPPEQ will also be a data source for law and accounting firms. Besides, this data can be pulled out to present anonymized reports on market and industry trends while the startup could also classify its clients into cohorts to give context to the data.

Sankar said the company is agnostic to how it receives the data. It could be through a portfolio company who becomes a client or a venture capital firm and the data can be shared in any format. TOPPEQ builds APIs to plug into their ledgers depending on the accounting system the client uses (QuickBooks, Tally). Its technology is built on AWS infrastructure, has a React-powered frontend, and offers a set of flexible options to clients on data storage.

“We come from a hedge fund background, we understand privacy, secrecy and permissioning. We have created very strong permissioning parameters within the application,” she adds.

Network effect

TOPPEQ's addressable market is fairly expansive. It would include anybody who sells equity (startups, small businesses), anyone who buys equity (angels and institutional investors) and anyone who facilitates an equity transaction (lawyers and auditors).

“These are our primary set of clients… they all work in the same ecosystem, they all look at the same data. The unique value proposition we offer will not just be attractive to venture capitalists and entrepreneurs, there is also the network effect which includes law firms, family offices, audit firms, banks and so on...” says Sankar.

While India will be a key target market, the US and UK are also on Sankar’s radar.

Given the addressable market, the platform comes to market at an opportune time. Since the outbreak of the Covid-19 pandemic and the subsequent lockdown of businesses and economies across the globe, early and later stage funding has all but dried up for private companies. Investors have become far more cautious with new investments and have turned extra diligent with existing ones in the market for follow-on funding rounds.

Like most startups, especially those in the formative stage, TOPPEQ has also had to grapple with the challenges of continuing to operate and build through the debilitating pandemic.

Sankar, however, says the impact (of the lockdown) was minimal given that the startup was in the build phase with employees operating on a ‘work-from-suitable’ location basis. But, her timelines to on-board the first set of a dozen-odd clients did get stretched. The startup currently has four clients and two more are in the final stages of getting on board. “I expect the process to extend to mid-July to hit the (dozen clients) target,” she says.

The startup is currently bootstrapped with the founder’s investment at Rs 4.5 crore. “We have the ability to draw down an additional Rs 2.5 crore. We intended to raise funds (from external investors) in Q4 of 2020. However, we have brought that timeline forward as we believe that it will take longer to close a round in this environment,” Sankar said.

While TOPPEQ claims it has no competitors in India, yet, there are global parallels. If the startup is able to ride out the current downturn, it has the opportunity to establish first mover advantage in a market that Sankar estimates at $250 billion in India alone.

Globally, San Francisco-based Carta, which was valued at $1.7 billion when it raised $300 million from venture capital firm Andreessen Horowitz last year, comes closest to what TOPPEQ is building, says Sankar. There’s also publicly traded share plan management software company Solium Capital, which Morgan Stanley acquired in a $900 million deal last year. Solium was subsequently renamed to Shareworks. Gust, OptionCap, CapTable.io, and Equity Effect are some of the other prominent cap table management software providers in the US market.