Deal Roundup: SirionLabs, ShipRocket lead dealmaking this week; early stage funding takes a backseat

Contract management firm SirionLabs and logistics platform ShipRocket grabbed the spotlight in an otherwise flat week for startup fundraising activities. The two deals accounted for nearly 67% of the total capital raised in the aforementioned period.

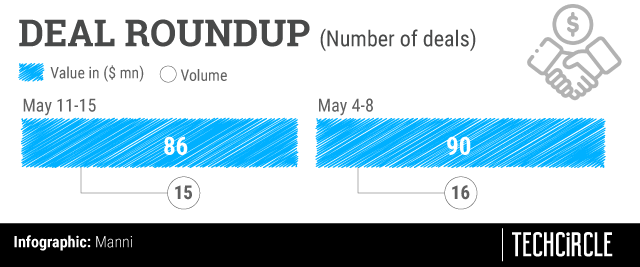

Overall, 15 startups raised funds this week, of which 10 accounted for $86.1 million. Five deals did not disclose their value. Last week, there were 15 deals as well, which saw a total capital infusion of $90 million.

Notably, there were a significant number of growth funding rounds -- funding rounds beyond Series B -- including the internal capital infusion rounds of cloud kitchen platform FreshMenu and grocery delivery startup MilkBasket. This is a departure from the recent trend, where seed and bridge rounds have dominated the funding activity.

In another divergent trend, fintech and edtech companies, which investors have been partial to since the Covid-19 outbreak, were conspicuously absent from the roster of funded startups.

Funding

SirionLabs: The Gurugram-based contract management startup raised $44 million in a Series C round led by New York headquartered alternative investments firm Tiger Global Management and private equity firm Avatar Growth Capital. Since its inception in 2012, the company has raised a total of $66 million.

ShipRocket: The technology-enabled logistics aggregator, based in New Delhi and owned by BigFoot Retail Solutions, raised $13 million in a Series C round, led by Tribe Capital. Venture debt firm Innoven Capital and returning investor Bertelsmann India Investments also pitched in. The latest capital infusion brought ShipRocket’s total funding to $26 million.

Nykaa: Mumbai-based beauty and personal care platform raised $8.85 million in an equity funding round from returning investor Steadview Capital. This is the London headquartered investor’s second capital infusion in Nykaa in as many months. In April, it had put in $13.2 million for a 3% stake in the ecommerce platform.

Intello Labs: The artificial intelligence (AI)-based agritech startup raised $5.9 million in a Series A funding round, led by new investor Saama Capital. Other new investors, including Singapore-based global agritech fund Grow and Los Gatos, California-based investment firm SVG Ventures, also participated in the round, along with returning investors Omnivore and Nexus Venture Partners.

Milkbasket: The Gurugram headquartered micro-delivery company raised $5.5 million in an internal round of funding -- or follow-on investment that involves only returning investors -- from Kalaari Capital, Mayfield India, Blume Ventures’ Opportunity Fund IIA, Unilever Ventures and Beenext, apart from an undisclosed Indian family office investor.

Magicpin: Samast Technologies, which owns the hyperlocal discovery platform, raised $3.89 million in a funding round led by returning investors Lightspeed Venture Partners and Lightspeed India Partners. Other participants in the round included The Bunting Family Private Fund, French investment firm Moonstone Investments, venture capital firm Waterbridge Ventures, as well as Srivatsan Rajan, a partner at global consultancy firm Bain and Company.

RentoMojo: Bengaluru-based Edunetwork, which runs the online rental marketplace, raised $3.23 million in an ongoing Series C funding round from returning investors Accel India, Chiratae Ventures, Bain Capital, BCIP Venture Associates and French-American entrepreneur Renaud Laplanche.

Doceree: New Jersey headquartered online marketing platform for pharmaceutical brands, which has operations in India, raised $1 million in a seed funding round led by Kumar Gaurav, founder and CEO of marketing platform Beyond Codes, along with other angel investors in India and the US. The healthtech startup will use the funds to acquire customers and scale its business in India and the US, it said.

Housing.com: The real estate platform, run by Gurugram-based Locon Solutions, raised $400,000 in a growth funding round from its Singaporean parent Elara Technologies. The capital infusion is part of a pre-existing $6.63 million (Rs 50 crore) funding plan.

FreshMenu: The company, run by Foodvista India, raised $400,000 from venture capital firm Lightspeed Venture Partners, and serial entrepreneurs Ganesh Krishnan and Srinivas Anumolu. The inside round saw Lightspeed invest about Rs 2.5 crore, while Krishnan and Anumolu invested Rs 25 lakh each.

Refrens: The Bengaluru-based fintech platform raised an undisclosed amount in an angel funding round. Investors in the round included Paytm founder Vijay Shekhar Sharma; Shaadi.com founder Anupam Mittal; AngeList’s venture fund The Collective; early-stage fund First Cheque, as well as senior startup executives.

Spyne: The AI-enabled photoshoot management platform, based out of Gurugram and owned by Eventila Technologies, raised an undisclosed amount in a bridge funding round, dubbed a ‘pre-Series A’ round, from returning investor Smile Group and other participants including AngelList, senior executives from online travel agency Yatra and budget hospitality chain OYO.

Charge+Zone: Vadodara headquartered TecSo ChargeZone, which owns electric vehicle (EV) charging solutions brand raised an undisclosed amount in a bridge funding round, dubbed as a pre-Series A round, from investor collective Mumbai Angels Network. The company will use the capital to develop technology for e-mobility integration of the platform with car manufacturers, utility companies and EV charging equipment manufacturers, it said.

Vastra App: The technology platform for textile companies raised an undisclosed amount in an angel funding round led by Vivek Khare, along with other members of early-stage investor collective LetsVenture, and apparel company Blackberrys.

GroCurv: The Gurugram-based business-to-business marketing and sales services procurement platform raised an undisclosed amount in a seed funding round from Singapore headquartered venture capital firm Unicorn Investments.

M&A

HealthAssure: The primary healthcare services aggregator acquired New Delhi-based Pasta Lifestyle Solutions, which offers subscription-based fitness services to corporates via its brand FitMeIn. As part of the deal, HealthAssure will allot equity shares worth Rs 50 lakh to Pasta Lifestyle, it said.