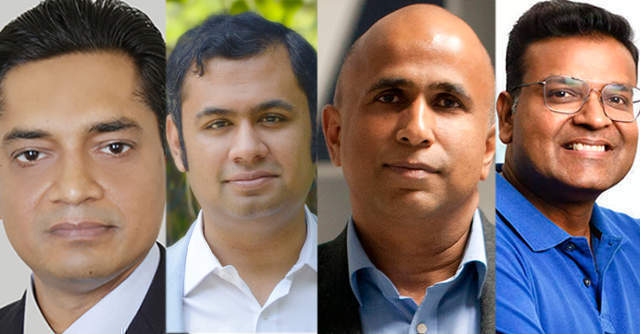

How startups and investors reacted to Budget 2020

From the deferment of taxes payable on ESOPs, to focusing on emerging technology to improve digital connectivity, the startup ecosystem was a star in finance minister Nirmala Sitharaman’s budget speech for the financial year 2020-2021.

Here’s a look at what stakeholders in the sector had to say about its impact on their businesses.

Amit Singh, co-founder and CEO, Shuttl

Startup industry has surely bagged two winning announcements in this budget. One is deferment of ESOPs which will not only help in employee retention but will also reinforce their trust in the company. Another good news for startups is the increase in the eligibility to claim to 100% profits deduction from the existing 7 years to 10 years.

Ashish Sharma, CEO, InnoVen Capital India

While details need to be studied, this budget only had a couple of announcements with respect to startups. The change in ESOP tax treatment and extension of the period available for startups to claim a tax deduction against accumulated losses are welcome moves.

Ruchit Agarwal, co-founder and CFO, CARS24

We expected the budget to announce measures that provide immediate fillip to automobile sales, as the industry emerges from perhaps one of the worst slumps in recent memory. However, no direct measures were announced. Hence we will have to wait for the government’s final stance on scrappage policy or any rationalisation of GST rates in this sector. On a broader note, lack of immediate measures to arrest auto sales augurs well for the used car industry as we believe consumers will continue to substitute buying used cars instead of new cars.

Sandeep Aggarwal, founder and CEO, Droom

I see the 2020-2021 union budget ensures continuity in the government’s long standing commitment to India’s growth by fueling technology and digital enablement. It is very encouraging to see that this government and the budget continue to recognise the startup ecosystem as the main locomotive of long-term sustainable growth for India. There is renewed focus towards the implementation of new-age solutions like artificial intelligence, machine learning, IoT and robotics for driving innovation… Also the decision of setting up a seed fund to support early-stage startups and an investment clearance and advisory cell for the entrepreneurs came as a gift for the Indian startup industry.

Saurabh Garg, co-founder and CBO, Nobroker

The budget is a mixed bag with its positives and misses. In a commendable move, the government has extended support to affordable housing. It has extended an additional Rs 1.5 lakh tax benefit on interest paid on affordable housing loans by one year. The extension of one year of tax holiday on profits of developers involved in affordable housing projects is a clear-cut indication of higher allocation of resources towards affordable housing. This focus on affordable segments comes as a win-win situation for both sellers and buyers.

The Government has also proposed measures to improve liquidity for NBFCs and HFCs. This would be a welcome move for the real estate sector which has been struggling with a liquidity crisis. The boost to growth of infrastructure and transport are positive steps to ease living in suburban parts of the cities.

However, tax exemptions on housing loans and interest payments have been removed. This will be negative for the real estate sector which is already under stress. House rent deduction has also been taken away and will burden the tenants. We were also expecting the stamp duty to be reduced or subsumed partially in GST which has also not happened and is a significant expense for the buyer

Saurabh Srivastava, chairman, Indian Angel Network

The FM has delivered a fantastic budget for startups. The measures announced on ESOPs, taxation and seed fund will infuse tremendous energy in the ecosystem. The clear message on no-undue harassment will provide renewed confidence to entrepreneurs to create new innovative startups which create jobs and wealth in India and strive to take over the world.

Bala Parthasarathy, CEO and co-founder, MoneyTap

Budget 2020 looks keen on taking the country towards a decade of growth. Nirmala Sitharaman has tried to strike a balance between welfare and corporate stimulus. Growth through the rural economy, manufacturing, infrastructure and tax reliefs seems to be the larger theme.

Better days for startups and MSMEs are ahead. I’m especially looking forward to the launch of app-based invoice financing loans for MSMEs. Deferred tax on ESOPs is huge -- it will reduce the tax burden on employees and help startups grow much faster due to the lowered cost structure in hiring & retaining better talent. It is great to see that the government is serious about education and skills training for the youth. However, we are yet to see substantial strategies to address massive job losses and four-decade high unemployment. All in all, it is a balanced budget in spite of the existing challenges.

Anuj Golecha, cofounder, Venture Catalysts

This year’s budget announcements are in line with the NDA government’s commitment to the startup ecosystem. Finance minister Nirmala Sitharaman has proposed several positive measures to address the roadblocks faced by startup owners and emerging entrepreneurs in the country. A dedicated investment clearance cell for providing end-to-end facilitation and support including pre-investment advisory, information on land banks and quicker clearance of funds at the state-level will boost the entrepreneurship culture in India. Maintaining sustainable growth remains a challenge for startups, but the government has also addressed this area by increasing the turnover limit for startups (from 25 crores to 100 crores) that can avail 100% profit deduction in three years out of ten years, against seven years previously. Moreover, tax payment by employees will be deferred on ESOPs from startups by five years or till they exit the company or when they sell their stocks, which will encourage more Indians to join startups.

Rohit Kapoor, CEO (India, South Asia), OYO

It is heartening to see a budget that focuses on improving standards of living as well as economic development. A grant of Rs 2,500 crores for tourism promotion and the development of five iconic archeological sites and museums in the country are bright indicators of the renewed focus of the government on the travel and tourism industry. Apart from these initiatives, the overall focus on increased disposable income, better infrastructure, better connectivity and digital push will help boost demand for the hospitality industry in India.

Ankit Jain, founder and JMD, Skootr

Setting up an investment clearance cell and a digital portal aimed at offering assistance to emerging entrepreneurs reflects the government's proactive measures in further enhancing the entrepreneurial spirit. Such a measure facilitating end-to-end clearance support can do wonders in reviving related projects. However, the details of this proposal are yet to be seen.

Srikanth Iyer, CEO and founder, HomeLane

Entrepreneurship is indeed the spirit of India! It is a delight that the Government has considered to encourage start-up owners and entrepreneurs by creating more opportunities, to help towards the clearance cell of investment… The focus on technology including AI/ML, robotics with number of productive age group cross-cutting streams in India is another exciting development… However, the fleeting mention on SOPs to boost real estate and affordable housing did not provide clarity. Entitlements for real estate and housing are extremely essential, especially for new homebuyers and those who want to set-up their homes.”

Gautam Bansal, SVP (finance), Shiprocket

We believe that this year's budget will boost the domestic economy. Despite her fiscal constraints, the finance minister has introduced policy measures that will stimulate domestic consumption, encourage investment and also strengthen the Indian infrastructure. Constructive policies have been launched in the field of integrated logistics. There will also be a visible improvement in MSME competitiveness as the government has allocated Rs 900 crore for their debt funding.

Divya Jain, founder and CEO, Safeducate

We are thrilled that the union budget has touched upon the greater finance needs for educational institutions in order to attract good teachers. For this, the decision to look at ECBs are FDI is definitely a step in the right direction. The setting up of apprenticeship programmes within 150 higher education institutes will have a significantly positive impact on skill development. Similarly, urban local bodies providing fresh engineers with job opportunities for one year, allowing them to learn on the job, will contribute to a highly-skilled workforce. The announcement of Rs 99,300 crore outlay in favour of the education sector in 2020-21 and a separate Rs. 3,000 crore for skill development is a welcome move for sure.

Abhishek Kothari, co-founder, FlexiLoans

The union budget 2020 has shown a ray of light for the fintech sector, with FM Nirmala Sitharaman stating that India will embrace a shared economy with aggregators displacing regular business. The importance of analytics, IoT, and AI has been recognised in this budget, as they are set to change the world. A policy has been announced to set up data centre parks all through the country.

Vamsi Krishna, CEO and co-founder, Vedantu

The vision of making education accessible to the farthest corner of the country will greatly benefit students. The allocation of budget to hone the skill sets of teachers and educators will positively impact quality learning and thereby provide a boost to the education sector. Additionally the allocation of budget to BharatNet will also have a deep impact on skilling rural India as it has the potential to open up online learning to students and professionals from remote villages. With better bandwidth internet, a qualified teacher located in a metro city can impart LIVE online classes to students in small town India, where there’s a dearth of quality education.

Aakrit Vaish, CEO, Haptik

As digitisation and advanced technologies continue to gain momentum, we welcome the budget 2020 announcements. Once again, the finance minister’s emphasis on machine learning, robotics, AI and IoT will help boost India’s digital journey. A significant proportion from the allocation of Rs 3,000 crore for skill development should focus on these cutting-edge technologies. We are also delighted to witness proposals such as the linking of 1,00,000 gram panchayats through the enhancement of BharatNet and setting up of data centre parks across the country. As national systems become more sophisticated and our workforce is equipped with the relevant skills, we will truly see the next wave of digital revolution, with greater scope for large-scale indigenous innovation

Anil Joshi, managing partner, Unicorn India Ventures

FM’s first full budget has something for everyone. She tried to address employment generation issues, providing access to education, emphasized on embracing tech and next-gen concepts like IoT, AI and ML. We are happy to see that the FM has kindly agreed to long pending demand from industry on ESOP, the new guidelines will certainly help startups attract good talent and reward suitably through ESOP, the ESOP guidelines will help in structuring the benefit to deserving employees. The increase in the turnover limits from Rs 25 cr to Rs 100 cr for claiming off-set on profits is a welcome announcement. It will boost cash flow situation at early-stage startups who sometimes fail before take off because of liquidity crunch. Also, by exempting companies with turnover upto Rs 5 crore, from audit, reduces compliance burden on them.

The Govt has also proposed a policy on early life and seed stage funding for startups to validate their business idea and run POCs, we believe, this would help grass root development and will encourage more university led IPs would good boost for innovators. However, the fine print will tell us what kind of financial support would early stage startups get in the coming months. We hope the procedure to avail these services are less complicated. Also, our industry’s demand on tax parity still remains unattended. However, we are hopeful that the govt will give it thought in time to come as we are continuously seeing the focus on startups and investors increasing in the last 5 years. Overall, it is a Budget with an aspiration to revive the economy from its current slowdown.

Mitesh Shah, head of finance, BookMyShow

At the onset, we would like to laud the government for a growth-driven budget. We welcome the progressive policies aimed at encouraging rural demand, changes in personal taxes to spur consumption, impetus to infrastructure development, measures aimed at bolstering growth and reversing slowdown. Additionally, taxation related to ESOPs as a perquisite and removal of DDT are significant moves. However, it would have been beneficial to have the benefits of taxation relief on ESOPs expanded to companies and industries at various stages of growth and not be limited to startups alone.

Compliance on e-commerce has been increased by mandating them to deduct a TDS of 1% on all goods and services sold on e-commerce platforms. This would be in addition to TCS under GST and this amendment might further increase the cost of compliance for e-commerce companies.

Ramakant Sharma, co-founder and COO, Livspace

The union budget provides welcome measures to support technology, startup and real estate ecosystems in the country. Deferring tax payments on ESOPs is a long-standing demand that has been addressed. This move would allow us to continue to attract highly skilled talent for our processes, without having them face the burden of being taxed on what was ideally supposed to serve as compensation. The proposal with regards to early life funding and a seed fund to support ideation and development of early-stage Start-ups would help encourage and empower more individuals to become entrepreneurs.

Saroja Yeramilli, CEO and founder, Melorra

We are happy to see that the budget this year has been pro-startups. The creation of an investment clearance cell for managing everything end to end including offering investment assistance to upcoming ventures is encouraging. It will motivate budding entrepreneurs and make processes easier for them. The government has also raised the limit for tax on profit for startups from INR 25 crore to INR 100 crore and the decision to tax ESOP at point of sale is a welcome one for startups.

K Ganesh, serial entrepreneur, GrowthStory

Some encouraging policies have emerged in the budget for the startup ecosystem to ensure ease of doing business. It is good to see a resolution of the issue of dual taxation on ESOP shares held by employees. The tax payment has been deferred by five years, or until employees leave the company, or when they sell their shares—whichever is earlier. This needs an amendment to ensure tax deferral is applicable till the slave of the shares and not till end of employment. This is because in most cases the issue arises when an employee leaves and needs to pay tax but there is no liquidity or cash flow since the shares are not saleable.

Startups in India have largely been kept outside the benefit of having the government as their customer, user or partner unlike in other countries. It is therefore good to see initiatives that will address this such as new technologies for direct benefit transfer, allocation to quantum computing and related technologies, use of AI / ML / data in healthcare, solar plans and focus on renewable energy. All this would mean large business for startups in these areas from the government.

Overall the budget is pro-health and an enabler for the startup ecosystem. It remains to be seen how the various policies are implemented. However, we expected a lot more to encourage investments into job creating sectors such as tax incentives and exemptions for angel investments. Parity on listed and unlisted securities tax exemptions is also not mentioned.

Musthafa PC, co-founder and CEO, iD Fresh Food

My personal favourite -- announcing an allocation of Rs 20,000 crore for the renewable energy sector, pushing for organic fertilisers and thereby encouraging the farmers to go for Solar energy instead of the traditional diesel/kerosine. It is a huge positive step as it reduces the carbon footprint on the environment.

I would have loved to see a 2 year GST exemption for products with plastic-free packaging. I strongly believe that something like this could incentivise businesses to come up with innovative solutions and alternative technologies to reduce their environmental footprint. Whether it’s replacing single-use plastic with eco-friendly materials or packaging solutions that focus on recycling, the FMCG industry needs the right push from the government to herald a green tomorrow.

Bhavin Turakhia, founder and CEO, Flock

We are delighted with the steps taken by the Government in the Union Budget towards providing an impetus to entrepreneurship and acknowledging that startups are major job creators. This year, the budget has allocated Rs. 3,000 crore for skill development, which will help in creating a future-ready workforce. The provision for setting up an investment clearance cell for entrepreneurs, an online portal to facilitate quicker business clearances, and a seed fund to support early-stage startups will all collectively attract foreign investment in Indian startups.

Harshil Mathur, CEO and co-founder, Razorpay

The budget does meet some of the expectations from the fintech industry and startups. The introduction of some sort of a tax relief on ESOPs was one of the biggest asks from the startup industry -- this deferment of tax payment by five years, to me, is one of the biggest welcome moves by the government in this budget. This is a good start and I hope we see more focus on this going forward. Secondly, the reduction on corporate tax to 22% is an encouraging step. This is the lowest in the world and will be encouraging for Indian businesses. Lastly, the changed income tax slabs and rates is not only a huge income tax relief for individuals but will also lead to an increase in disposable income, thereby giving a boost to consumer spending.

Subho Ray, president, IAMAI

The focus on Technology and Digital Infrastructure is a step towards realizing the trillion-dollar economy and will open up new opportunities for demand generation. the vision to provide digital connectivity to all public institutions at gram panchayat level in FY 21, is ambitious and will usher in the much-needed digital revolution under the Digital India initiative, and will also help in the last mile connectivity. This will also bridge the Rural-Urban digital divide, and will open avenues to jobs and employment creation. According to IAMAI, the budget duly acknowledges the positive role of emerging technologies such as AI, IoT, Quantum Computing, in the new world economy.

Rahul Garg, CEO and founder, Moglix

The budget seeks to strike the right note with the themes of aspiration, economic development, and caring society. The outlay on infrastructure projects worth Rs 100 lakh crore and schemes for revitalizing the manufacturing of new world items, should help revive investment. The government has recognised the contribution of startups to the economy via incentives such as tax breaks on ESOPs for 5 years, tax rationalisation for startups with Rs 100 crore turnover and digital platform for startup IPR. Measures for improving the ease of doing business such as the NIVRIK scheme, removal of Dividend Distribution Tax and simplification of the GST regime will bring back investor confidence. MSMEs are the mainstay of a vibrant economy and it is good to see the budget improving credit access and increasing cash in hand for these businesses. We hope for the momentum to continue in implementation as well.

Tim Nicolle, founder, PrimaDollar

The FM’s announcements under union budget 2020 introducing new schemes will help the small players in the export sector in a big way. The new Nirvik scheme introduces high insurance cover for exporters at a reduced premium. Simplified processes for faster claim settlements will be beneficial for both the exporters and the general insurers.It will lead to providing high insurance cover, reduction in premium for small exporters and simplified procedures for claim settlements,this will encourage export finance. This will boost exports. Coming to the MSMEs, the announcement for the subordinate debt for entrepreneurs is a big positive and will help the MSME sector benefit in a massive way. These seem to be sound measures that can stimulate profitable activities for players in the trade and finance sector.

Harsh Jain, co-founder and COO, Groww

The government's decision to spend Rs 6,000 crore on BharatNet to increase accessibility to the internet will give a huge boost to internet-based companies -- fintech being a prominent sector that will benefit from the move. This will enable e-commerce and fintech companies, particularly the ones operating in the investment and lending domains, to serve customers in parts of the country that are not served by more traditional offline service providers and increase their footprint.

Indroneel Dutt, CFO, Cleartrip

The government has backed its vision to turn India into one of the world’s top tourism hubs by allocating Rs 2,500 crore for promoting tourism in general and setting aside a sum of Rs 3,100 crore for the culture ministry to boost regional tourism. What would be wonderful is to have an empowered nodal body comprising the govt / OTA / airline, hotel and other industry representatives with the objective of promoting discoverability, ease of booking and fulfillment of our cultural, natural and heritage sites. We also welcome the FM’s proposal to develop 100 more airports as well as the doubling of the airline fleet by 2024.

TA Krishnan, CEO and co-founder, Ecom Express

The government’s focus on logistics is highly appreciated. The National Logistics Policy is a constructive move and will bring a positive shift in the logistics industry’s current position. Creation of single-window clearances and rolling out more favourable policies is another step as logistics is important and will act as a catalyst in driving economic growth. These steps in budget will foster employment generation and skill development which are vital to sustainable and long-term growth.