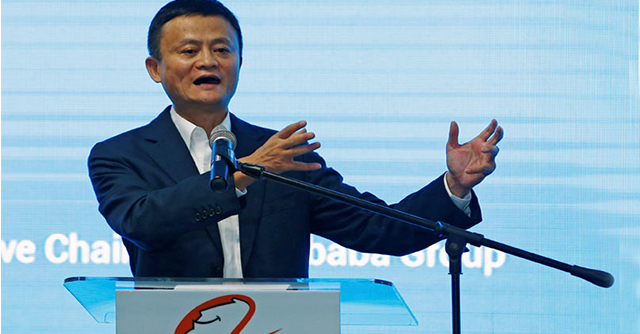

Deal Talk: Jack Ma's Ant Financial plans a $1 billion fund; Vogo, Spinny line up for fresh capital

Alibaba Group affiliate Ant Financial is lining up a $1 billion fund that will back startups in Southeast Asia and India, Bloomberg reported, citing sources.

The report followed an earlier one by DealStreetAsia which said that the $1 billion fund, named Ant Unicorn Fund, would invest chiefly in businesses related to online payments. The report cited Ant Financial vice president Ji Gang, who spoke to the publication on the sidelines of a conference in Beijing on Tuesday.

In India, Ant Financial has investments in Delhi-based One97 Communications, owner of payments platform Paytm and foodtech unicorn Zomato, among other startups. This week, Ant Financial joined an investor consortium to pump a reported $1 billion into Paytm.

In September this year, Jack Ma-founded Alibaba Group acquired a 33% stake in Ant Financial, which was earlier known as Alipay, ahead of the latter’s upcoming public market debut.

Vogo in talks for $40 million

Vogo Automotive, which operates an eponymous scooter-sharing platform, is in talks to raise $40 million in an equity funding round led by Lightstone Aspada, along with Korean investor Mirae Asset Management, Mint reported, citing sources. The company has reportedly been in the market for the last few months to raise close to $50 million from Goldman Sachs and Steadview Capital.

Aspada is set to invest $15 million and Mirae Asset will put close to $4 million in the round. Existing investors Stellaris Venture Partners, Matrix Partners and Kalaari Capital will invest the rest, the report said.

The Bengaluru-based company widened its losses to Rs 39.2 crore in financial year 2018-19 against Rs 3.3 crore a year earlier. Revenues for the year grew to Rs 7 crore from Rs 2 crore in the previous year.

Spinny aims for a $50 mn round

Gurugram-based Spinny, a used-car buying and selling platform, is set to close a $50 million funding round with three new investors coming in, Mint reported. New investors include growth equity firm Norwest Venture Partners, US venture capital fund General Catalyst, and Fundamentum, a firm set up by Infosys founder Nandan Nilekani and former Helion Ventures partner Sanjeev Aggarwal, the report said.

Existing investors Blume Ventures and SAIF Partners will also participate in the round. Accel will invest from its global growth fund, valuing Spinny at around $150 million, the report said citing sources.

Spinny was founded in 2015 by Niraj Singh and Ramanshu Mahaur. In June this year, Indian Angel Network made a full exit from the startup.