Does Infosys have a problem with outsider CEOs?

Early this week, information technology (IT) services firm Infosys found itself staring at a second whistleblower complaint in four weeks, this one also concerning CEO Salil Parekh. A new letter, which became public on Wednesday, accused the CEO of spending more time in Mumbai than at the company’s headquarters in Bengaluru and incurring company expenses to travel frequently between the two cities.

Infosys is yet to respond to clarifications sought by the Bombay Stock Exchange on the new allegations.

In a breather for the IT services company, the company’s share price didn’t take a tumble similar to the one it experienced when the first whistleblower complaint pertaining to allegations of inflating revenues and margins by a whistleblower group calling itself ‘ethical employees’ surfaced. Investors, most likely, consider the issues in the second letter too trivial to be taken seriously.

However, the seemingly trivial nature of the complaint does beg the question -- does the country’s most celebrated IT services company have a problem integrating outsider CEOs?

"The outsider CEOs are not conforming with the company values and culture and obviously some people at the senior management levels are upset. And the board is not strong enough to put an end to this. The fact that the CEO spends a lot of time in Mumbai is true. The people coming from outside don't have an understanding of Infosys culture and need to spend time in Bengaluru to understand the culture," a former top-rung executive at the company said.

Parekh is not the first professional CEO from outside Infosys to come under scrutiny. Vishal Sikka, who was brought in from German technology major SAP, faced a number of challenges when he took over the reins from co-founder SD Shibulal in 2014. Most of all, his compensation, considered high, was often questioned by some of the founders, especially NR Narayana Murthy, who reportedly had several run-ins with Sikka.

Infosys’ founder CEOs -- after Murthy stepped down in 2002, the founders rotated the CEO’s job among themselves till 2014 -- often took home modest salaries but had a lot of equity to compensate for the lower compensation.

What eventually proved to be Sikka’s undoing was the Panaya acquisition. The $200 million price tag for the February 2015 acquisition was considered too high and questioned by many.

In the nearly two years that Parekh, recruited from French IT consulting multinational Capgemini, has been at the helm, he’s had a decent run, until now. Since taking over, he’s steered Infosys through a stronger performance compared with its peers, even beating TCS in revenue growth for a few quarters, a far cry from where these rivals were during the major part of this decade.

The company’s investors have seen the share price gain 37% in just 22 months. For a company with a market capitalisation of $42 billion, that is an addition of $14.5 billion of cumulative wealth added to investors’ kitty. In the last six quarters, Infosys had surpassed TCS’ growth rate in three and the company’s growth guidance for the current fiscal is also higher than any other large IT services player barring HCL.

The whistleblower allegations that surfaced in early October point fingers at Parekh and CFO Nilanjan Roy with respect to the use of unethical practices to boost the company’s earnings.

"People might have views on accounting practices, but those are not material here, I believe," said the former executive cited above said. “The smaller issues raised, some of which seems to be true, show that there is disgruntlement,” he added.

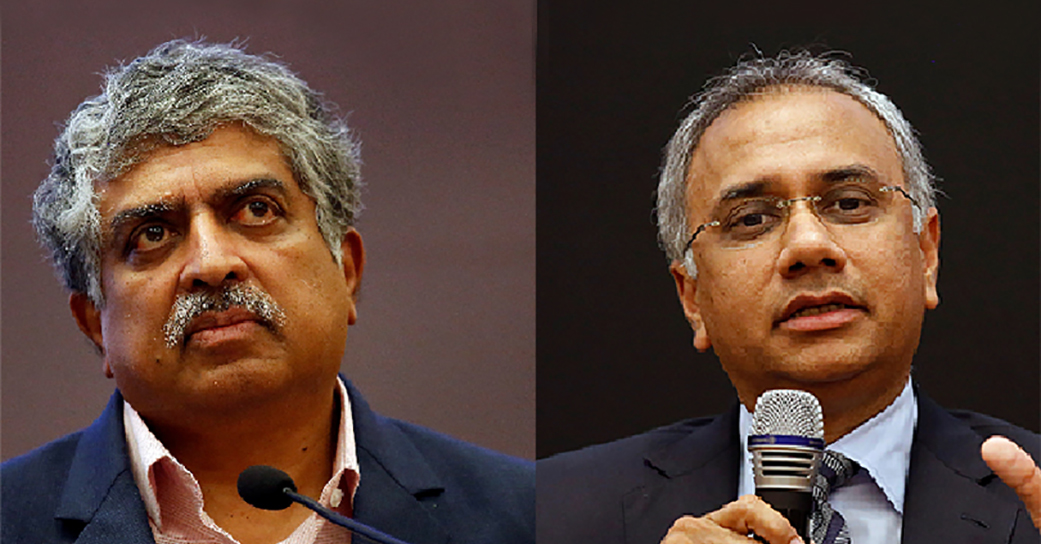

"If a CEO calls board members Madrasis, it is bad manners at the highest level. The board has a hands-off approach and that is not working here especially with a CEO who does not understand the culture well… the chairman Nilekani has failed with his approach and he needs to change it," he said.

Some quarters hold the view that the root of the problem is that the transition from founder-promoter to a professional CEO and board has been drastic, with little continuity. "Software companies are culturally strong firms with a strong founder connection to the foundation of the firm. When Sikka was brought in, some of the founders should have continued at the helm," said another Infosys former executive, who also requested anonymity. “TCS is still driven by company veterans while HCL and Wipro having a strong founder driven professional management,” he added.

It’s a view that is echoed by others. Jessie Paul, a former marketing executive with Infosys and Wipro, said that the issue is a clear case of the company’s top management failing to address unhappiness and disgruntlement at the senior management levels. "While earlier they had an audience with the founders on a daily basis, that touch has been lost when a professional CEO came in, which is a communication gap," she said.

Shriram Subramanian, founder of Bengaluru based corporate governance and advisory firm InGovern believes that the second whistleblower complaint, while seemingly frivolous in nature, still hurts the company’s image. "There could be the possibility of a cultural clash between those who have been with the company for long and the new outsider CEO. The board should send a strong message that such trivial whistleblower complaints are not tolerated," he said.

Industry watchers had earlier told TechCircle that the company should have been more forthcoming with disclosures to prevent bad publicity.

Another investor said that while such cultural dissonance is usual when transitions happen, with Nilekani on the board, the matters would have turned out differently if the board has intervened earlier and spoken with the employees.