SoftBank takes ownership of WeWork with $9.5 bn rescue deal

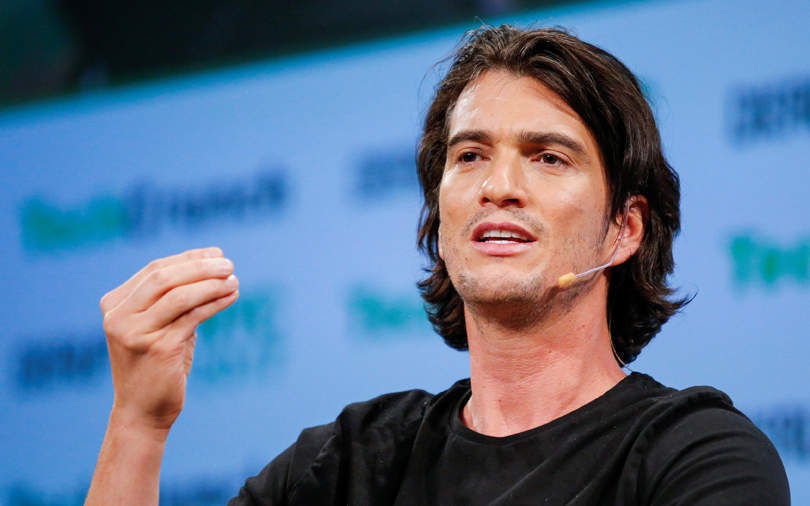

About a month after its founder Adam Neumann stepped down as CEO, co-working giant WeWork and its largest investor SoftBank Group Corp have agreed on a $9.5 billion rescue plan for the beleaguered company.

As per the terms of the deal, SoftBank will bring in $5 billion in new financing and launch a tender offer of up to $3 billion for existing shareholders, according to a joint statement. In addition, SoftBank said it will accelerate the infusion of an existing $1.5 billion commitment into WeWork.

“The funding provides WeWork with significant liquidity to execute its business plan to accelerate the company’s path to profitability and positive free cash flow,” the statement said.

The completion of the deal will see SoftBank owning approximately 80% of the New York-based company. WeWork will be an associate of SoftBank henceforth.

"SoftBank is a firm believer that the world is undergoing a massive transformation in the way people work. WeWork is at the forefront of this revolution. It is not unusual for the world’s leading technology disruptors to experience growth challenges as the one WeWork just faced. Since the vision remains unchanged, SoftBank has decided to double down on the company by providing a significant capital infusion and operational support. We remain committed to WeWork, its employees, its member customers and landlords," said Masayoshi Son, chairman and CEO of SoftBank Group Corp.

According to a CNBC report, WeWork’s valuation plummeted to just $8 billion as it accepted the bailout offer from SoftBank. SoftBank’s technology focused mega Vision Fund had backed WeWork at a valuation of $47 billion in January this year.

The new agreement also includes the appointment of Marcelo Claure, CEO of SoftBank Group Corp, to the position of executive chairman of the board of directors of WeWork, effective upon the closing of the accelerated $1.5 billion commitment. Neumann will become a board observer. The size of the board will be expanded and it will receive voting control over Neumann’s shares, the statement added.

According to the new finance package, all of SoftBank Vision Fund’s interests in regional joint ventures outside of the Japan joint venture will be exchanged for shares in WeWork at $11.60 per share.

It isn't clear at this point how the proposed share swap would impact the India arm of WeWork. In India, WeWork India operates as a joint venture between Jitu Virwani-owned Embassy Group and WeWork's global parent The We Company. Embassy Group owns around 90% in the joint venture.

According to a recent report by Reuters, the India franchise is in talks to raise $200 million from new investors after its discussions with private sector lender ICICI Bank for a $100 million funding round fell through on account of WeWork’s botched public market debut.

The Wall Street Journal reported that SoftBank would pay Neumann as much as $1.7 billion in a deal that would see him step down as chairman and give up his voting rights.

WeWork founder Neumann stepped down from his position last month after concerns were raised over the valuation that could be achieved in an initial public offering.

“While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive,” Neumann said in a statement at the time.

WeWork vice chairman Sebastian Gunningham, a former Amazon executive, and chief financial officer Artie Minson, a former Time Warner Cable executive, were appointed as co-CEOs.

“The new capital SoftBank is providing will restore momentum to the company and I am committed to delivering profitability and positive free cash flow. As important as the financial implications, this investment demonstrates our confidence in WeWork and its ability to continue to lead in disrupting the commercial real estate market by delivering flexible, collaborative and productive work environments to our customers,” Claure said.