Investors keep piling into fin-tech; logistics platform BlackBuck close to unicorn status

Startups in the financial technology segment yet again remained the flavour of the week even as logistics company BlackBuck came close to joining the unicorn club after closure of a Series D funding round worth $150 million.

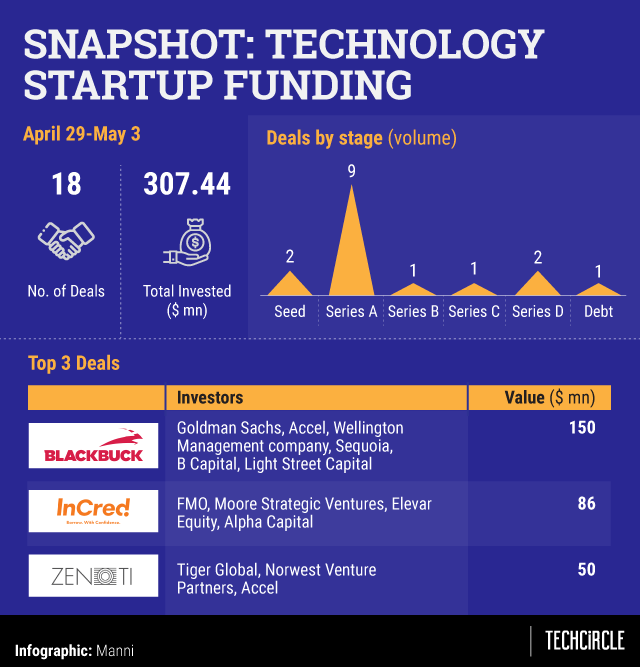

To be sure, at least 18 startups raised more than $307 million in funding this week across sectors including ed-tech, logistics, fintech, home-tech, and industrial Internet of Things (IoT).

Among investors, storied venture capital firms including Tiger Global Management, which showed renewed enthusiasm for the Indian market lately, was active again this week along with other well-known names such as Norwest Venture Partners and Accel.

BlackBuck: Soon-to-be unicorn

Logistics-tech startup BlackBuck said it had closed its Series D round worth $150 million (about Rs 1,040 crore). In a statement, the company said that the round, which was led by Goldman Sachs and Accel, also saw the participation of US-based asset management firm Wellington Management Company, Sequoia, B Capital and Light Street Capital.

By TechCircle’s estimates, BlackBuck’s current valuation now stands at approximately $924 million.

Zinka Logistics Solutions Pvt. Ltd, which owns BlackBuck, was founded in 2015 by IIT-Kharagpur alumni Rajesh Yabaji, Chanakya Hridaya and Ramasubramaniam B. The company provides logistics solutions for long-haul trucking. It brings together shippers and truckers through its online marketplace to facilitate inter-city freight transportation.

More money into fin-tech

Investors can’t get enough of fintech startups. This week, InCred Financial Services Ltd raised Rs 600 crore ($86 million at current exchange rate) -- significantly big for a Series A round -- in a funding transaction led by Dutch development bank FMO.

InCred plans to use this capital to boost its balance-sheet lending, as well as to make further investments in technology initiatives to drive analytics and risk-management capabilities.

InCred has a presence across more than 20 cities in India and plans to expand to a number of Tier-III cities. The Mumbai-based company launched operations in January 2017.

The firm disburses four types of loans -- personal, education, home and SME (small and medium enterprise).

Another fintech startup that managed to secure funding was Happy, an online lender to small and medium enterprises (SMEs). It raised $20 million (Rs 140 crore) in a fresh investment round from investors in India and the United States (US) to grow its artificial intelligence (AI)-powered lend-tech model.

The startup said it raised $3 million in equity funding from a few undisclosed individuals based in India and the US, and the rest $17 million in debt funding from institutions including DMI Finance, which is an Indian non-banking financial company (NBFC).

Happy, owned by ArthImpact Finserve Pvt. Ltd, plans to enhance its back-end processes to better evaluate new borrowers with the capital raised. It also aims to disburse over one million loans over the next financial year, besides reducing loan fulfilment period to under one minute.

Another fintech company, Ftcash, raised Rs 50 crore in its Series A round led by US non-profit firm Accion International and Dutch development bank FMO.

SaaS picking up pace

This week also saw a Software-as-a-Service (SaaS) company securing a reasonable amount. New York-based investment firm Tiger Global Management led a Series C funding round of $50 million (Rs 350 crore) in Zenoti, a software provider to salons and spas.

Seattle- and Hyderabad-based Zenoti, owned by Soham Inc., was founded in 2010 by serial entrepreneur Sudheer Koneru and his brother Dheeraj Koneru.

Zenoti offers a full stack of services catering to the beauty and wellness industry that includes booking appointments, billing and payments, customer relationship management, staff management and inventory control and analytics.

Its client roster includes Truefit & Hill, Lakme, Kaya Skin Clinic, Blunt, Waxing the City, Message Heights, Mario Tricoci, Prose Boutiques, Sono Bello and Rudy’s Barbershop.

Other startup funding deals:

While technology-enabled financial services and consumer internet businesses have become investor favourites, similar businesses in education tech, hyper-local delivery and speech recognition have also started attracting interest.

- Gurugram-based micro-delivery grocery startup Milkbasket said it has raised Rs 20 crore ($2.8 million) from BAC Acquisitions, the personal investment vehicle of Flipkart co-founder Sachin Bansal.

- Mihup Communications Pvt. Ltd, which offers a platform that recognises speech in English, Hindi and Bengali, raised Rs 12.5 crore ($1.8 million at current exchange rate) from new investor Ideaspring Capital and previous investor Accel.

- Altizon Systems Pvt. Ltd, which owns a platform to develop solutions based on industrial IoT, raised $7 million in its Series A round of funding led by TVS Motor Co. (Singapore) Pte. Ltd, a wholly-owned subsidiary of motorcycle company TVS Motor Company Ltd.

- Co-living startup Housr Technologies Pvt. Ltd, which has been operating in stealth mode for the past six months, raised funding from a clutch of senior real estate executives.

- The family office of business conglomerate Godrej Group invested $1.2 million (Rs 8.3 crore) in smart energy solutions provider ZunRoof Tech Pvt. Ltd in a pre-Series A round of funding.

- Venture capital firm Matrix Partners led a fresh funding round for an undisclosed sum in education technology startup Pesto, which runs a career accelerator for software engineering talent in the country.

- Bengaluru-based Bounce, which owns a scooter and bicycle rental platform, received about $1 million from telecommunications and semiconductor major Qualcomm.

Consolidation

The week, yet again saw one acquisition deal.

MakeMyTrip Ltd acquired a majority stake in Mumbai-based online corporate travel management company Quest2travel.com India Pvt. Ltd, adding to a slew of strategic bets it has made in the past few years to expand its offerings.

Nasdaq-listed MakeMyTrip didn’t disclose financial details of the transaction.

Deep Kalra, MakeMyTrip founder and group chief executive, in a statement said this investment will help MakeMyTrip extend its service offerings to large companies for their travel requirements while helping Quest2Travel benefit from the travel expertise and depth of supplier relationships that MakeMyTrip has forged over the years.