Flipkart's Bansals are no more billionaires, shows Hurun India Rich List

The wealth of e-commerce major Flipkart's Sachin Bansal and Binny Bansal (not related) has eroded significantly and they have been dropped off from the billionaires' list, according to the latest Hurun India Rich List. The latest ranking by the financial research firm that focuses on wealth status of high-net-worth individuals in China and India, shows that Bansals' dropped 55 positions from the previous year with their wealth declining 42% to Rs 5,400 crore (over $800 million) from Rs 9,010 crore (around $1.3 billion) last year.

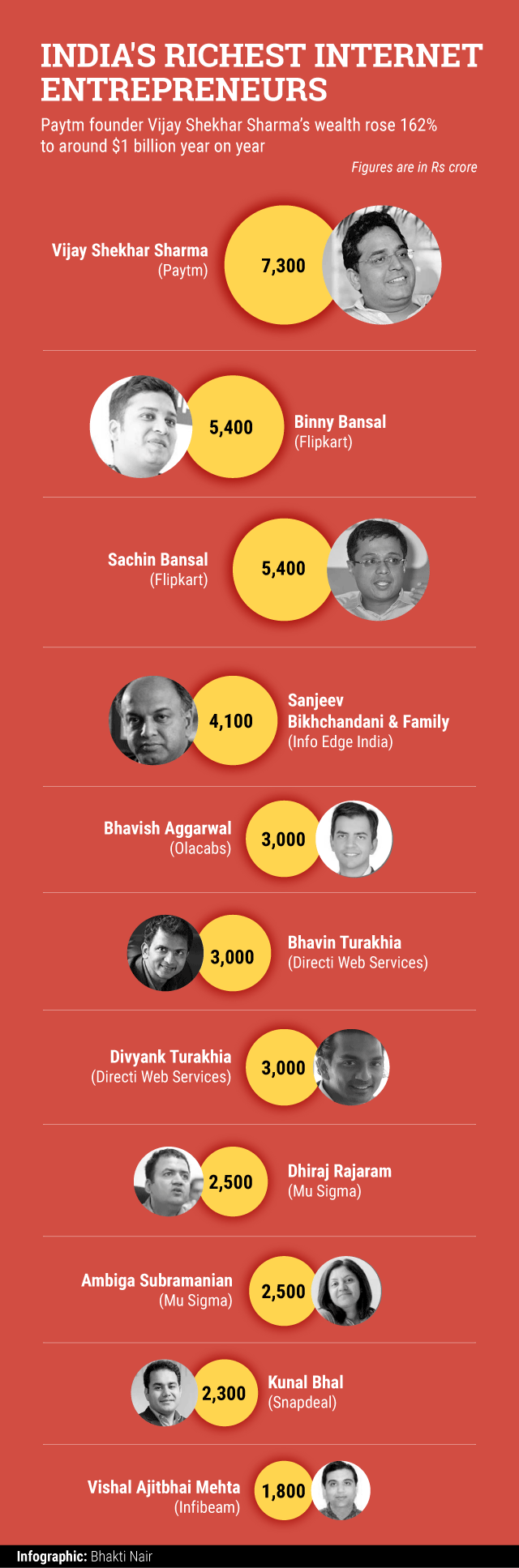

Vijay Shekhar Sharma, founder of Alibaba-backed online payment and e-commerce firm Paytm, has emerged the richest startuprenuer in the country with Rs 7,300 crore ($1 billion) wealth. Sharma is the biggest gainer with a 162% rise in his fortunes year on year.

This year marks a phenomenal fall in the fortunes of Flipkart's Bansals considering that the e-commerce firm's founders witnessed a 56% rise in their wealth last year. Their individual wealth grew from Rs 5,104 crore (around $764 million) each in 2014 to Rs 9,010 crore ($1.3 billion) each in 2015.

Bansals entered the Harun's rich list for the first time earlier this year when the research firm estimated that they were each worth around $1.3 billion as of January this year.

Bansals also debuted on business magazine Forbes India' rich list last year at number 86, with $1.3 billion net worth each.

The markdowns by some of its investors that brought down Flipkart's valuation significantly lower than the last year's peak of $15.2 billion has resulted in the founders also significantly losing the value of their assets.

On why Bansals came down on the list, Anas Rahman Junaid, managing director and chief researcher, Hurun Report India, said, "It is more about how the company performed rather than individuals."

"We have factored in the heightened competitive pressure in the e-commerce market with Amazon's decision to invest $5 billion in India. This was not there last year," he said. "All matrices available in terms of GMV, sales and burn rate suggest there is a competitive pressure on Flipkart and this is supported by markdowns on its valuation by the investors," Junaid said.

Year 2016 has been a tough period for Flipkart—several mutual fund investors have marked down its valuations, Amazon is nipping at its heels and it is seen struggling to raise funds. In addition, a hiring fiasco, where it deferred the joining dates of IIM Ahmedabad graduates, forced it to face to the ire of one of the elite business schools in the country. Job cuts have made matters worse.

In January this year, Binny Bansal had taken over as Flipkart's CEO while Sachin Bansal, who has been holding chairman and CEO positions, was moved to the role of executive chairman. Later, Sachin Bansal revealed that he had to step down as the company's CEO and take up the chairman's position after missing performance targets. Bansal made this disclosure at a town hall meeting with Flipkart employees on 19 August.

Haresh Chawla, a partner at India Value Fund Advisors, had said in a blog in April that growth at Flipkart had stalled since the middle of last year and that the leadership team hadn't figured out a way to enhance sales.

Of the 21 tech and software entrepreneurs in Harun India Rich List this year, only six are billionaires while last year it featured nine billionaire techpreneurs.

Vijay Shekhar Sharma's wealth rose by 162% to Rs 7,300 crore (around $1 billion) year on year making him the richest entrepreneur under 40 this year.

Acharya Balakrishna, the man behind yoga guru Baba Ramdev's consumer goods empire Patanjali Ayurved, entered the Hurun India Rich List this year with a wealth of Rs 25,600 crore (around $3.8 billion).

Bhavish Aggarwal of cab hailing company Ola is the youngest in the list at 30 with a wealth of Rs 3,000 crore (around $452 million). Kunal Bahl, 32, of e-commerce firm Snapdeal had a wealth of Rs 2,300 crore (around $346 million).

Hurun said its valuation of non-listed companies was based on a comparison with their listed equivalents using prevailing industry multiples such as price to earnings, price to sales, enterprise value to sales, enterprise value to EBITDA and also other methodologies including discounted cash flow, Tobin's Q and so on. In certain cases of early stage companies, the firm has used First Chicago Method for valuation, it said. Tobin's Q is a method used to find value of shares of unlisted companies and First Chicago Method is a context-specific business valuation approach used by venture capital and private equity investors.

According to information from the balance sheets of tech unicorns in India, Kunal Bahl and Rohit Bansal, co-founders of e-commerce marketplace Snapdeal, each got Rs 46.5 crore in total executive compensation in the year ended on 31 March 2015, that catapulted them to the joint seventh-highest paid executives in the country. The Snapdeal co-founders' pay packet was bumped up due to stock options that comprised some Rs 45 crore of the total remuneration for each of them.

Compensation figures for Flipkart founders Sachin Bansal and Binny Bansal could not be collated as their remuneration is believed to be tied to international holding companies.

Sachin Bansal was paid a nominal sum from one of the two key Indian operating companies of the group. Flipkart Pvt. Ltd, the holding company of India's top e-commerce firm, is incorporated in Singapore.

Like this report? Sign up for our daily newsletter to get our top reports.