Exclusive: Student education tracking app Uolo raises seed funding

Student education tracking app Uolo, run by Uolo Technology Pvt. Ltd, has raised $210,000 (around Rs 1.4 crore) in seed funding from Purvi Ventures, Sunstone Business School director Rajul Garg and Vipin Arora.

Student education tracking app Uolo, run by Uolo Technology Pvt. Ltd, has raised $210,000 (around Rs 1.4 crore) in seed funding from Purvi Ventures, Sunstone Business School director Rajul Garg and Vipin Arora.

Others who participated in this round include Exponentially I Mobility LLP and Artieca Family Trust, according to VCCEdge, the data research platform of VCCircle. Six individuals also participated in the funding round. The deal was closed in February this year.

"The funds will be used to upgrade the tech infrastructure, and on-board more schools," said Ankur Pandey, co-founder, Uolo, confirming the development.

The company will also focus on expanding its services to north India. Currently, the Uolo app has 200 schools on board in 20 cities in south India.

In October 2014, Uolo had raised $78,000 from Ravi Srivastava, co-founder and managing partner at Purvi Capital LLC besides seven other individuals.

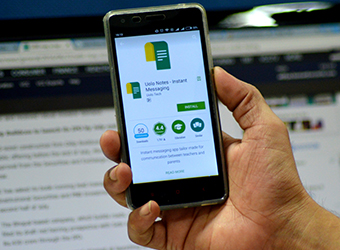

The Uolo app allows schools to send information regarding homework, marksheets and attendance directly to parents to help them track the progress of their wards.

"The Uolo app (acronym for You Only Live Once) functions like a WhatsApp for schools, removing the need for a diary, bulk SMS or emails," said Pandey.

The company was founded in 2014 by Pandey, an alumnus of Indian School of Business, and Badrish Agarwal, an IIM Ahmedabad alumnus. Prior to starting up, both of them worked at US-based Target Corporation.

Another player in the student performance assessment space is Edsys which has an app that helps parents connect with teachers and schools on their children's academic progress.

In the ed-tech segment, most recently Bangalore-based Paratus Knowledge Ventures Pvt. Ltd, which runs Fundamentor, has raised an undisclosed amount of funding in a seed round from entrepreneur and former venture capitalist Subramanya SV recently.

Byju's has secured the biggest investment in this segment, having secured $75 million (about Rs 500 crore) from Sequoia India and Belgian investment firm Sofina.

Like this report? Sign up for our daily newsletter to get our top reports.