Online recharge & mobile wallet MobiKwik raises $25M from Tree Line, others

Gurgaon-based One MobiKwik Systems Pvt Ltd, which runs online recharge platform and mobile wallet venture MobiKwik, has raised $25 million (over Rs 150 crore) in a Series B round of funding led by Tree Line Asia, it said on Wednesday.

Cisco Investments, American Express and existing investor Sequoia Capital, also participated in the round.

The firm will use the money in technology/data analytics verticals, brand building and growing the network of users and merchants.

"With over 15 million wallet users, and neutrality towards 25,000 merchants, we are now aiming for the next level of growth and building a ubiquitous mobile wallet for a billion Indians. With 90 per cent of Indians being unbanked, simplified payments via a mobile wallet make perfect sense," said Bipin Preet Singh, founder and CEO, MobiKwik.

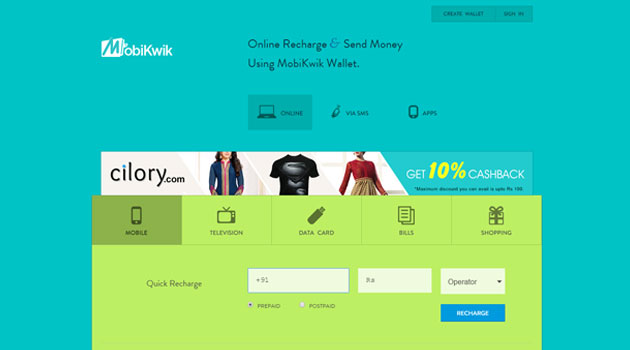

Founded in 2009 by Singh (CEO) and Upasana Taku, MobiKwik is a platform for prepaid mobile, DTH and data card recharges, post-paid mobile bills payment and utility bill payment for electricity, gas and landline connections.

It claims to have over 15 million users and 25,000 merchants (retailers) currently.

MobiKwik is focusing to create a brick-and-mortar retail network of over 100,000 merchants across India. These stores will serve both as points for cash loading into the wallet and for wallet payments acceptance. The company has also applied for a payments bank licence.

It recently tied up with Café Coffee Day, where customers can pay for their coffee and snack across all CCD outlets via their MobiKwik wallet. The firm is looking at more such offline payments partnerships in the future.

MobiKwik had earlier raised under $5 million in its Series A funding from an unnamed VC firm. This is believed to be Sequoia, which is now being counted as an existing investor in the firm. The VC firm had earlier also backed Zaakpay, another payments venture started by the same co-founders.

MobiKwik competes with the likes of Paytm (recently got huge investment commitment from Alibaba and SAIF Partners) and Freecharge (which is into online recharges business).

Ambit Corporate Finance was the exclusive financial advisor to the latest funding transaction.

(Edited by Joby Puthuparampil Johnson)