The most common mistake when forecasting growth for new products (and how to fix it)

Startups are about growth

Paul Graham's essay in 2012 called "Startup = Growth" makes a big point in the first paragraph:

A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of "exit." The only essential thing is growth. Everything else we associate with startups follows from growth.

The other important reason for new products to focus on growth is simple: You're starting from zero. Without growth, you have nothing, and the status quo is death. Combine that with the fact that investors just want to see traction, and it's even more important to get to interesting numbers. In fact, later in the essay, pg talks about how important it is to hit "5-7% per week."

Getting to this number while trying to show a hockey stick leads to a bad forecast. Here's why.

The bad forecast

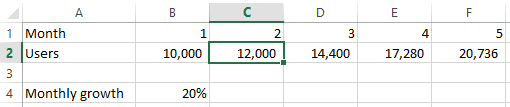

The most common mistake I see in product growth forecasts looks something like this:

In this example, the number of active users is a lagging indicator, and if you multiply this lagging indicator of a growth curve, it's a truism that the growth will go up and to the right. If you do that, the whole thing is just a vanity exercise for how traction magically appears out of nowhere.

And of course these growth curves look the same: They all look like smooth, unadulterated hockey sticks. The problem is, it's never that easy or smooth. In reality, you're upgrading from one channel to another, and in the early days, you do PR but eventually that doesn't scale. Then you'll switch to a different channel, which takes some time but also eventually caps out. Eventually you'll have to pick one of the very few growth models that scale to a massive level.

The point is, incrementing each month with a fixed percentage hides the details of the machinery required to generate the growth in the first place. This disconnects the actions required to be successful with the output of those actions. It disassociates the inputs from the outputs.

The way to create a better forecast is to focus on inputs, not outputs.

How to fix this forecast

A more complete model would start with a different foundation.

It would:

- Focus on leading indicators that are specific to your product/business – not cookie cutter metrics like MAU, total registered, etc.

- Start with inputs not lagging vanity metrics

- It'd show a series of steps that show how these inputs result in outputs

- And, how the inputs to the model would need to scale, in order to scale the output

If you plan to 2X your revenue for your SaaS product, which is done by doubling the # of leads in your sales pipeline, and those leads come from content marketing – well, then I want to know how you'll scale your content marketing. And how much content needs to be published, and whether that means new people have to be hired.

That also means that if you want to 2X the your installs/day, and plan to do it with invites, I want to understand the plan to double your invites or their conversion rates.

Or better yet, say all of this in reverse, starting with the inputs and then resulting in the outputs.

Inputs are what you actually control

Focus on the inputs because that's what you can actually control. The outputs are just what happens when everything happens according to plan.

One helpful part of this analysis is that it helps identify key bottlenecks. If your plan to generate 2x in revenue requires you to 5X sales team headcount when it's been hard to find even one or two good people, you know it's not realistic. If your SEO-driven leadgen model assumes that Google is going to index your fresh content faster and with higher rank than it's ever done, then that's a red flag.

In the end, it's also true what they say:

No plan survives contact with the enemy. — smart german guy

Keep that in mind while you fiddle around with Excel formulas, and you'll be in good shape.

The post The most common mistake when forecasting growth for new products (and how to fix it) appeared first on @andrewchen.

(Andrew Chen is an entrepreneur and blogger based in Palo Alto, CA. He blogs here.)

To become a guest contributor with VCCircle, write to shrija@vccircle.com.