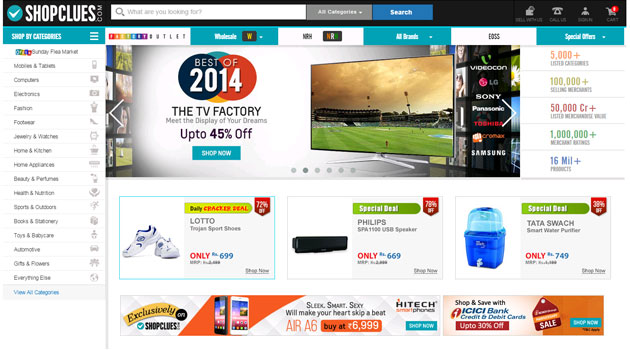

E-com marketplace ShopClues raises $100M in Series D funding led by Tiger Global

Clues Network Inc, the US-based parent of Clues Network Pvt Ltd that runs the horizontal e-commerce marketplace ShopClues, has raised $100 million (Rs 620 crore) in Series D funding led by Tiger Global besides two of its existing investors, the firm said on Monday.

This values the company at around $450-500 million, a company executive privy to the development said on the condition of anonymity.

The money will be used in product development and roping in more merchants on board, the firm said.

The company had previously raised money from Helion Venture Partners, Nexus Partners and Beenos (formerly Netprice, a Japanese incubation cum investment group). It scooped $10 million in Series B round in March 2013. Prior to that it had raised around $5 million in Series A.

It also raised an undisclosed amount—which is believed to be around $15-20 million— in Series C in April-May 2014 from Nexus and Helion.

Beenos, however, did not participate in Series C nor the latest round.

"So far we have brought 100,000 sellers and 10 million products online and the next three years will be focused on bringing 10 million sellers and 1 billion products to the online domain. We will continue to build technologies and services to enable and empower retailers to participate in the e-commerce revolution that is happening in India," said Sanjay Sethi, CEO and co-founder, ShopClues.

Lee Fixel from Tiger Global said, "Shopclues has emerged as the leading marketplace of choice for the millions of small and local businesses seeking to reach mass consumers in India's tier 2 and tier 3 cities. Sanjay, Radhika and the team have done a great job aggregating the country's largest online catalogue of regional and local brands and we are excited to partner with ShopClues as it expands its offerings."

The Gurgaon-based startup was founded by former Wall Street tech analyst Sandeep Aggarwal and a former eBay executive Sanjay Sethi in July 2011.

Prior to setting up ShopClues, Aggarwal was a senior internet and software analyst at Caris & Company, a San Francisco-based, research-driven boutique investment bank. He had also worked with companies like Collins Stewart, Oppenheimer & Co., Citigroup Investment Research, Microsoft Corp, Charles Schwab and Kotak Securities.

Sethi was earlier the head of global product management at eBay and also worked with companies like TradeBeam and Steel Authority of India. An IIT-Delhi alumnus, he also holds a B.Tech degree in Mechanical Engineering from Indian Institute of Technology (Banaras Hindu University), Varanasi.

The company went through a tumultuous period over the last two years after Aggarwal (then CEO) was found to have indulged in insider trading in the US in his past job and he later pleaded guilty to the charges. He has disassociated himself with his executive role at ShopClues. His wife Radhika Ghai Aggarwal has taken over more a direct role and is handling marketing at the firm and listed as a co-founder now.

Meanwhile, Sethi became CEO after Sandeep Aggarwal was arrested in the US.

A few months back ShopClues was again in news when one of the merchants selling through its platform was found to be allegedly selling counterfeit products under the L'Oreal brand. The Delhi High Court had restrained it from using the name of L'Oreal to sell or supply any goods.

Currently, ShopClues claims to be doing 1.5 million transactions per month with 70 per cent of it coming from tier II & III cities. It claims to have 40 million monthly visitors.

It says it focuses on unstructured/unorganised categories which contributes to two-thirds of its gross merchandise sales unlike other marketplaces, which tend to focus on mobile, electronics, computers and branded fashion.

The firm had clocked net revenues of around Rs 30 crore with net loss of Rs 38 crore for the year ended March 31, 2014.

Avendus Capital was the advisor to ShopClues on this transaction.

ShopClues works on a zero-inventory marketplace model like Snapdeal, where sellers can display their product catalogues and it facilitates the transaction. However, unlike Flipkart or Amazon, which also run marketplaces in India, it does not have any associated firm which is also a vendor on its platform.

It is among a few horizontal e-tailers still active in the country where the business has got consolidated among the top three players: Flipkart, Amazon and Snapdeal. While Flipkart raised over $1.9 billion in three different rounds, Snapdeal was not much behind with close to $1 billion in multiple rounds in 2014. Another horizontal e-com peer is HomeShop18, which draws bulk of its business from TV or home shopping.

One97 Communications, which runs mobile commerce platform Paytm, is also in the final stages of sealing an investment worth over $600 million.

For Tiger Global, this marks yet another big bet on Indian e-com sector. It is one of the top investors in Flipkart and the investment in ShopClues makes it one of its most direct competing investments to date.

(Edited by Joby Puthuparampil Johnson)