Overall Indian smartphone shipments in Q2 touch 18.42M units, Micromax inching closer to Samsung for market leadership: IDC

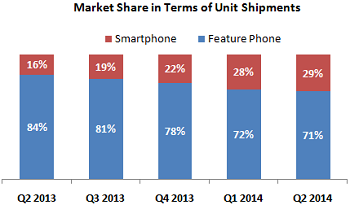

India's smartphone shipments in the second quarter of 2014 stood at 18.42 million units, recording a year on year growth of over 84 per cent over Q2, 2013, and a quarterly growth of 11 per cent. The potential for growth in the smartphone market is still quite high as 71 per cent of the market continues to be comprised of feature phones.

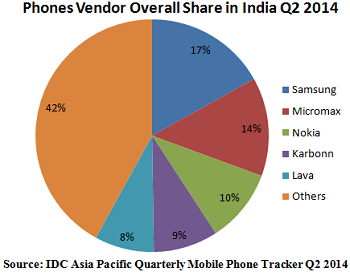

The overall India mobile phone market (smartphones and feature phones) stood at 63.21 million units in the quarter, witnessing a five per cent quarter-on-quarter growth against Q1, 2014, according to a report by International Data Corporation (IDC).

Among the top five vendors, Micromax and Lava were the only ones to have outstripped the market growth. While Micromax grew by 18 per cent, Lava saw a 54 per cent growth in the overall phone business. Interestingly, in addition to toppling Nokia to become number two in the overall mobile phone segment, Micromax also created a gap between the second and the third spot.

The top three vendors in the segment were Samsung (17 per cent market share), Micromax (14 per cent market share) and Nokia (10 per cent market share) respectively.

Smartphone segment growth

Back to back volume growth in the smartphone market is being noted due to the re-defined low price models in smartphones and continuous migration from feature phones to smartphones. The sub $200 (Rs 12,194) category of the smartphone market is increasing in terms of the shipment share as the contribution from this category stood at 81 per cent in the quarter.

With the influx of Chinese vendors and Mozilla's plans to enter the smartphone category at $50 level, the low end segment of the smartphone market will become crucial in the coming quarters.

The shipment contribution of 'phablets' (5.5-6.99 inch screen size smartphones) in Q2 2014 was noted to be 5.4 per cent of the overall smartphone segment. Phablet category grew by 20 per cent quarter-on-quarter in terms of sheer volume, with more than half being under $250 price band (Indians brands dominated this price range).

"While Samsung has held on to its leadership position in the market, it is noteworthy that Micromax is growing faster. Samsung needs to continue to address the low-end of the market aggressively, and also needs a blockbuster product at the high end to regain momentum. Given the current growth rates, there is a real possibility of seeing vendor positions change in the remaining quarters this year," said Jaideep Mehta, VP and general manager - South Asia, IDC.

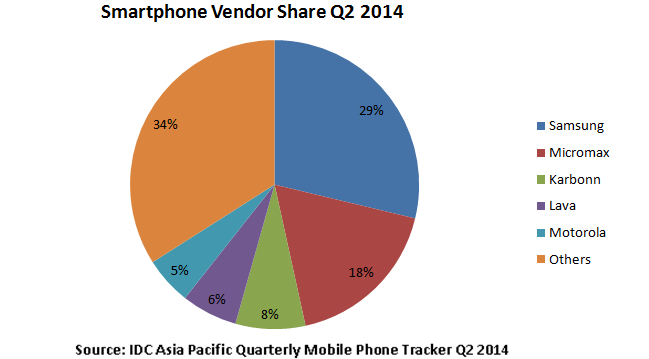

Top smartphone vendors

Samsung maintained its leadership position with 29 per cent market share in Q2, 2014. High volume support for the company came in from the sub $150 products such as Galaxy Star pro and Galaxy S Duos. However, in order to maintain their leadership in the market, Samsung needs to work on the margins at the entry level models.

Micromax came second with 18 per cent of the market share, followed by Karbonn with 8 per cent. However, the gap between Micromax and Karbonn has widened significantly.

Lava and Motorola completed the top 5 with six and five per cent market share respectively, with Lava being within striking distance from Karbonn. Despite being available only through online channel (exclusively on Flipkart.com), Motorola has crossed the million mark within five months of its launch, and has maintained its success story in the smartphone market in the country.

What's in store?

With the entry of Chinese vendors and repeated challenges being poised by the Indian vendors, the entry level segment of smartphone market has become a game changer and plays an important role in defining the leadership position. The smartphone market will witness high growth in the coming quarters due to the festive season and continuous run rate buying from the consumer.

In the competitive mobile phone market, there is a high possibility of a shuffle in the ranking within the top five smartphone vendors in the coming quarters.

"Smartphone market is expected to more than double between now and 2018 and much of this is expected to be driven by the migration from feature phones to smartphones. The user expectations are simple- they want best-in-class user experience at affordable prices. With the introduction of Mozilla and Android One, the sub $200 segment is anticipated to become even more appealing," added Kiran Kumar, research manager, client devices at IDC India.