Flipkart vs Amazon: how they stack up in India

The big daddy of online commerce in India hit a new milestone bagging a record $1 billion in fresh funding. In less than 24 hours of this announcement, the one thousand pound gorilla of selling things online Amazon followed it up with $2 billion in fresh investment commitment in India.

Mind you, in the services business paying salaries to employees and adding human skill set are also considered investment and with both firms employing thousands, a good chunk of this money could be simply about paying wages (though Flipkart has said it's looking much beyond using investors' money to burn in existing operations). Moreover, this could also include the imputed value of discounts to be offered to consumers.

Nevertheless, the numbers are huge and have just raised the decibel levels in the Indian e-commerce sector. Here we attempt to glance at how Amazon and Flipkart are stacked against each other when it comes to India in terms of some comparable metrics and other features.

Products on offer

Amazon claims that in just over a year it had pooled in vendors to offer as many as 17 million products on its site. It has not clarified whether this represents stock keeping units or SKUs but that is what it most likely means. Flipkart, which has been in operations for almost seven years now, looks to be on a weak wicket here as its latest communication says it stocks over 15 million products. Snapdeal is far behind with over 5 million products.

Indeed, what really matters is how much they are able to sell, but in terms of offering to the consumer, Amazon seems to have done a much better job and far quicker too.

Amazon does not share finer details about how many users it has in India; so that one is not comparable. Flipkart, in contrast, says it has 22 million registered users clocking over 4 million daily visits and is delivering 5 million shipments a month, which in itself is huge.

Who sells more?

Flipkart said early this year it has hit the milestone of $1 billion gross revenue (gross merchandise value or GMV) run rate (which means based on monthly sales on its site it is set to cross $1 billion in GMV over the next 12 months (though its latest official communication erroneously says it has become the first Indian e-com firm to hit $1 billion in GMV).

Amazon, though public listed, does not share India-specific numbers but its founder and chief Jeff Bezos has just said that at the current scale and growth rates, India is on track to be its fastest country ever to reach $1 billion dollars in gross sales. It is estimated that it took it years to cross the revenue benchmark even in China, where it has been present since 2004 and another market dominated by local giants.

But it would be fair to assume that Flipkart currently outsells Amazon.

Interest in virtual world

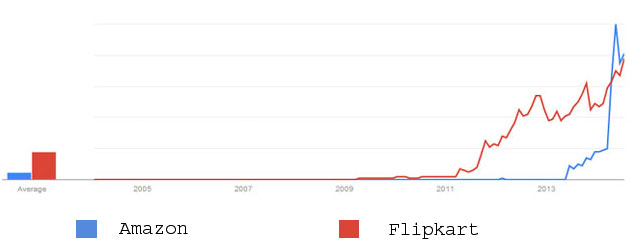

This one is somewhat superfluous but we look at it to get some additional insights. Rather than looking at Alexa (which is dismissed by many as not too accurate) or comScore (which we don't have access to), we considered Google Trends to see how the two sites stack up against each other.

As the graph shows, Flipkart has been under the radar for over five years but really took off only three years ago and with momentary blips has been on an ascend. Amazon has been growing at about the same pace as Flipkart after its launch in June 2013. However, it seemed to have gained pace in April this year and surpassed Flipkart and though the gap has narrowed since then, it seems to have stayed at the top this month too.

Amazon Prime vs Flipkart First

Not much of a comparison really, as Amazon Prime, the paid membership programme of Amazon, is not yet present in India. However, Flipkart has got a head start with launch of its own version of the premium membership last month. Though its benefits are limited to one vendor (more on that later), it manages to stand up against Amazon's Fulfilled by Amazon service under which consumers are already getting free deliveries for majority of products sold on the platform.

Flipkart First (at present in a free trial period for randomly chosen members) is currently limited to free or subsidised delivery benefits for a section of its product assortment besides an early access to hot products.

Where the battle may be won, however, is other bling factor in terms of digital content strapped for free. Amazon already offers such content for its Prime members and early this year paid a bomb for a package of shows from HBO which now comes free to its premium members. It also offers movies, music on the go and free e-books for its Kindle users as part of the membership.

Flipkart has got the platform to redo this. But having tried and exited digital music store it would be a challenge for it to sew such content deals going forward.

It remains to be seen by when Amazon would roll out Prime membership in India.

X-factor

One crucial thing in the e-com war could be the key vendor on the sites. In the case of Flipkart it is WS Retail, which used to be the in-house and sole seller through the platform before it turned a marketplace early last year. This firm is owned by an angel investor and employees of Flipkart, to comply with FDI norms. However, this is a key player for Flipkart. Although, the breakup of sales from WS Retail and other vendors is not in the public domain, it is estimated that the bulk of its sales are through this vendor (it also happens to be the partner for Flipkart's run away hits like Motorola Moto series of handsets). WS Retail also happens to be a key spoke in its Flipkart First offering, at least for now.

Amazon is still dependent on its third-party vendor base to sell in India. However, it has reportedly sealed an unconventional deal with Catamaran Ventures, the private investment arm of Infosys co-founder N R Narayana Murthy. Catamaran is holding a majority stake in a venture which is supposed to work at the back-end of operations for Amazon in India. However, this is seen as the first step for preparing groundwork for Amazon to start selling in India on its own as and when (as anticipated soon) multi-brand online retail is brought on par with offline retail in terms of FDI norms.

This could really pump up the activity for Amazon and take the competition right to the door steps of Flipkart.

Apparel

Flipkart has strengthened its apparel vertical, one of the juiciest part in terms of margins by acquiring Myntra early this year. Although Amazon also has launched apparel section, Myntra provides a strong positioning and vendor base to Flipkart which can be important going forward.

Myntra remains a separate site but its chief is now involved in strategy making for Flipkart's own apparel vertical and that can help the firm boost sales from this segment going forward.

To be fair, Amazon may well acquire a Myntra rival (say, a Jabong, for instance) to plug this gap that would be dependent on nifty deal structuring.

Reviews, vendor services, fulfilment centres

One differentiator for Amazon globally is its enviable consumer reviews, which helps a prospective buyer to decide in their purchase decisions. Flipkart too has built a strong review database and in many cases has a far comprehensive review section compared with Amazon's Indian marketplace.

If customer acquisition was key metrics to focus for Flipkart or for that matter any internet commerce firm to begin with including Amazon, now add vendor acquisition to it.

The future pace of growth for both be partly if not fully dependent on how fast they add sellers to their platforms. A factor determining this would be how smooth Amazon or Flipkart offer to get their products to the consumer. This would in turn be dependent on the fulfilment infrastructure and logistics services offered by the two firms. Both Amazon and Flipkart have their own logistics units unlike many other horizontal e-tailers in India and vendor addition could be based on who takes the minimum fee or cut from the sale of products on the site. This is where the money aspect comes in where the fresh funding announcement of Flipkart and additional investment by Amazon make them even-steven.

Meanwhile, Amazon has just announced five new fulfilment centres in India which would take total such facilities to seven in the country. Flipkart has four such centres at present and is also looking to expand the number.

We will get more insight on how the two firms are performing a couple of months down the line. So watch out this space for their actual revenues and growth in numbers.

(Edited by Joby Puthuparampil Johnson)