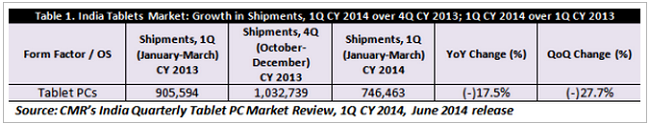

Overall Indian tablet shipments in Q1, 2014 touch 0.75M units; a QoQ decline of 27.7% primarily due to growth of phablets: CMR

India's overall tablet shipments in the first quarter of 2014 (Jan-Mar 2012) touched the 0.75 million (746,463 to be exact) units mark, recording a year on year decline of 17.5 per cent, and a decrease of 27.7 per cent quarter on quarter- due to the growth of the phablets, as well as vendors battling Bureau of Indian Standards (BIS) certification guidelines.

For those who don't already know, phablets (derived from the amalgamation of smartphones+tablets) are basically large screened mobile phones that come with a display screen that is bigger than 5 and less than 7 inch in size.

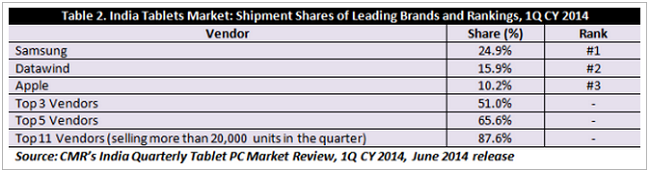

While as many as 30 domestic and international vendors shipped tablets in the quarter, only eleven vendors shipped in significant volumes of more than 20,000 units during the period, according to a report released by CyberMedia Research (CMR).

"The tablet shipment results are very much in line with our expectations. BIS certification issues had a temporary impact. However, rise in popularity of phablets has diminished the significance of tablets among potential consumers, particularly in the sub Rs 15,000-20,000 price category," said Faisal Kawoosa, lead analyst, CMR Telecoms Practice.

Note that CMR uses the term 'shipments' to describe the number of tablets leaving the factory premises for original equipment manufacturers (OEM) sales or stocking by distributors and retailers. In the case of tablets imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers. Also, CMR does not track the number of tablets brought on their person by individual passengers landing on India soil from overseas destinations, as well as tablets for distribution by the Government of India or state governments (as part of their social welfare schemes, scholarship programmes, etc.).

Enterprise tablets market

The enterprise segment of the tablet market is on the rise, with it contributing to around 22.1 per cent of the total tablet shipments during Q1, 2014. However, the challenge there remains bringing to market solutions-oriented tablets rather than plain computing and general content consumption devices.

"In such a scenario, the hopes of the tablet industry are pegged high on enterprises. As vendors launch more solutions-oriented devices, with a mix of software and hardware improvisations, we should see tablets gaining adoption within the enterprise segment," added Kawoosa.

Top vendors

Samsung led the market and accounted for almost a quarter of the total tablet shipments in the quarter (24.9 per cent to be exact). Controversy-driven Datawind came second with 15.9 per cent market share, while Apple completed the top three with 10.2 per cent market share. Interestingly, Apple was back in the top three after the first quarter of 2013. The top three vendors accounted for over half (51 per cent) of the total tablet shipments, while the top five vendors accounted for over 65.6 per cent shipments.

Samsung continued to be the leader in the category primarily due to its diverse product portfolio with offerings at various price points, screen sizes and connectivity perspective. Apple returned to the top three after almost a year on the back of an aggressive marketing campaign and strong sales of iPad Mini that contributed almost 60 per cent of Apple's total India iPad shipments during the quarter.

"Today, the India market has only 30 players competing in the tablet segment, as compared to an all-time high of 68 during Q2, 2013. This shows that the Indian tablet market has seen consolidation in recent quarters, as all the players who launched products could not generate sufficient sales to sustain operations. Going forward, it will be interesting to watch how the 7-inch tablet market, which currently contributes close to 80 per cent of total sales, will emerge from the expected stiff face-off from phablets," concluded Tarun Pathak, analyst, CMR Telecoms Practice.