Handset shipments in India rise 10.9% to 69.2M in Q3, feature phone sales decline for the first time

India's overall handset shipments in the third quarter of 2013 (July-Sept 2013) crossed the 69.2 million units mark, recording a year on year growth of 10.9 per cent, according to a report released by CyberMedia Research (CMR). Out of these, 19.5 million units (or 28 per cent) were shipped in the month of September alone.

While the smartphones segment recorded a 152 per cent Y-o-Y growth, the feature phone segment witnessed its first ever negative Y-o-Y growth of 0.8 per cent in the Indian mobile handset market.

"This means vendors can expect to see large opportunities in the upgrades market where many feature phone users will upgrade to a smartphone. There is going to be a huge opportunity as well as competition in the entry-to-mid level smartphone segments, which is where the volumes would remain for a while," said Faisal Kawoosa, lead analyst, CMR Telecoms Practice.

Note that CMR uses the term 'shipments' to describe the number of handsets leaving the factory premises for original equipment manufacturer (OEM) sales or stocking by distributors and retailers. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. Also, CMR does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or 'grey market' handsets.

Nokia was the overall market leader (smartphones + feature phones combined) with 18.9 per cent market share, followed by Samsung (12 per cent) and Micromax (10.8 per cent).

Rise of the smartphones

A total of 11.1 million smartphones were shipped in the country in the quarter, taking the contribution of smartphones to 17.6 per cent of total mobile handset shipments during the period July-September 2013. And while Nokia was the overall leader, Samsung continued its dominance of the smartphone segment.

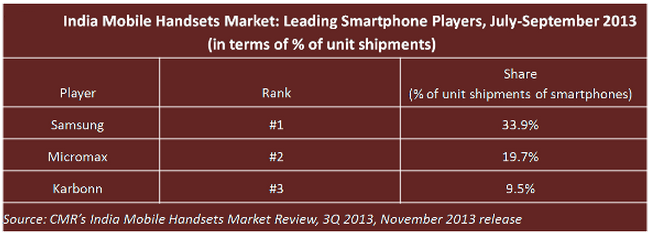

Samsung accounted for more than one third of the segment (33.9 per cent), followed by homegrown players Micromax (19.7 per cent) and Karbonn (9.5 per cent). Combined, the top 3 vendors make up nearly 63.1 per cent of the total smartphone shipments.

"Going forward, we expect the smartphone segment to be even more competitive as we expect some of the China-based original design manufacturer (ODM) partners entering directly into the India market during the first half of 2014," said Tarun Pathak, Analyst, CMR Telecoms Practice.

"Another interesting observation is that local handset brands have now close to 47 per cent market share in the India smartphones market and this momentum has been a source of confidence to a couple of players to enter new geographies outside India where the smartphone market is on the rise," he added.