Will there be a Series A crunch in Europe?

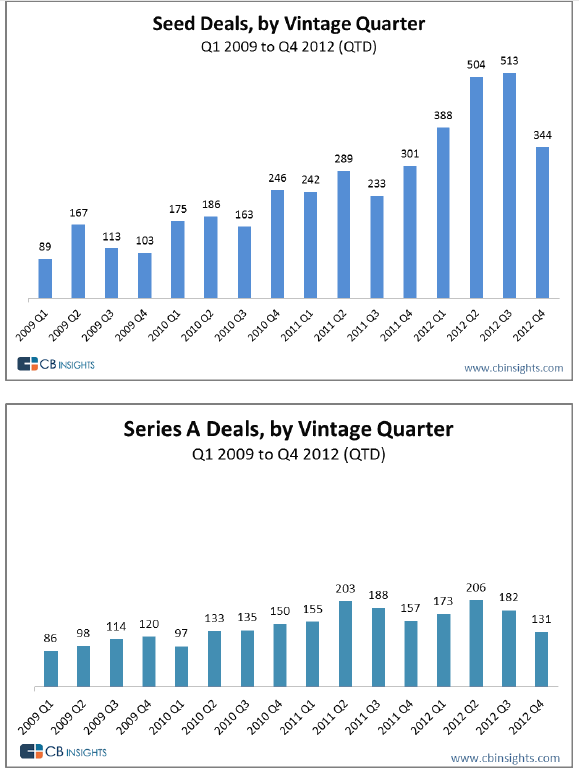

The coming Series A crunch is perhaps the hottest topic of conversation in US tech circles at the moment and the numbers in the charts above show why. The number of seed deals has shot up whilst the number of Series A deals has stayed flat, ergo the percentage of seed deals that go on to raise Series A will fall, perhaps by as much as two thirds. People are predicting that as many as 1,000 angel invested companies will fail next year.

This data is from the US and I haven't found anything comparable for Europe so answering the question of whether or not we will have a Series A crunch here is more difficult. What we do know here is that the VC investments are roughly flat at c£1bn a year in the UK and maybe the same again around Europe, implying that Series A investments are also flat, as is the case in the US. So if there is to be a Series A crunch here it will be for the same reason as in the US; because the number of seed investments has ballooned.

In place of interrogating the data we can look to see if the factors that drove the increase in seed funding in the US are present here in Europe:

- declining costs of innovation has made it possible to create more value with less investment improving the return profile of small investments (in theory at least) –innovation costs the same the world over.

- many people have recently been made millionaires because they held shares in Facebook and other tech companies that achieved big exits or because they founded companies that were acquired for $10-50m – only in the US (regrettably).

- accelerator and incubator programmes are funding large numbers of companies – also happening in Europe, but not to the same extent as the US.

(Nic Brisbourne is partner at DFJ Esprit, one of Europe's leading venture capital firms. The post has been reproduced with the author's permission from his blog, The Equity Kicker.)

To become a guest contributor with VCCircle, write to shrija@vccircle.com.